For entrepreneurs and investors targeting high-growth sectors with national strategic backing, the African Leather and Footwear industry represents one of the continent’s most compelling, yet consistently undervalued, opportunities. This sector, stretching from the rural kraals of livestock farmers to the high-end retail stores of global cities, is ripe for transformative capital and modern manufacturing expertise.

Africa, despite possessing the world’s largest livestock population—roughly 33.3% of the global herd—captures less than 4.5% of the $400 billion global leather trade. This deficit is not a measure of failure, but a measure of immense, untapped potential. Kenya, in particular, is positioned as a strategic gateway to unlock this value, driven by strong governmental policy and world-class infrastructure initiatives.

This comprehensive guide, dissects the profitability, operational costs, and strategic ecosystem of the Kenyan and wider African leather sector, establishing the essential knowledge required to make you a market leader.

I. Best Businesses Types in Leather and Footwear

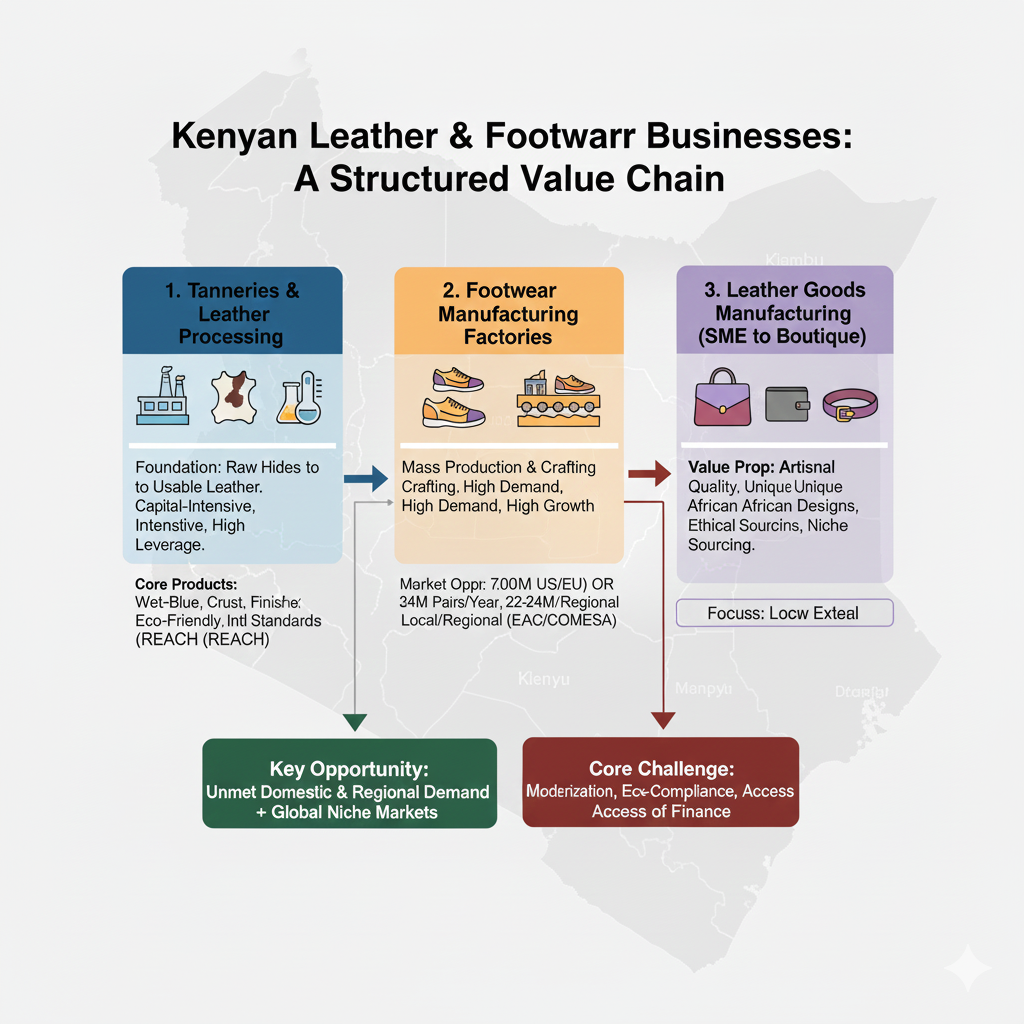

The leather sector is not monolithic; it is a meticulously structured value chain comprising three primary business segments, each offering distinct risk profiles, investment levels, and profitability margins.

1. Tanneries and Leather Processing 🏭

Tanneries are the foundational business segment, responsible for transforming raw hides and skins (a by-product of the meat industry) into stable, usable leather. Investment here is capital-intensive but offers the highest long-term leverage over the entire value chain.

- Core Products:

- Wet-Blue Leather: A semi-processed, chromium-tanned product suitable for export or further processing.

- Crust Leather: Further processed and dried, often exported for finishing abroad. This segment holds a high value addition potential for initial investors in Kenya.

- Finished Leather: Ready-to-use leather, dyed, treated, and finished to specific texture and thickness (e.g., for automotive upholstery, luxury bags, or high-end footwear). Value addition at this stage can be +320% over raw hides.

- Strategic Focus for Investors: Modernization, compliance with stringent international standards (e.g., REACH regulations for European markets), and embracing sustainable, eco-friendly tanning methods to address the sector’s environmental footprint.

2. Footwear Manufacturing Factories 👞

This segment focuses on mass production and specialized crafting of shoes, boots, and sandals. Kenya’s local demand far outstrips supply, making this a high-demand, high-growth area.

- The Market Opportunity: Kenya’s annual total footwear consumption is estimated at 34 million pairs. Local production meets only a fraction of this, leaving an import deficit of approximately 22–24 million pairs per annum.

- Business Model: Factories can pursue either an export-oriented strategy (leveraging duty-free access to the US and EU markets) or a local footprint strategy, targeting the massive, unmet domestic and regional (EAC, COMESA) demand for quality, locally-made leather shoes.

3. Leather Goods Manufacturing (SME to Boutique) 💼

This encompasses the creation of high-value consumer products such as designer handbags, wallets, belts, jackets, and accessories. This segment has a low barrier to entry for artisans and SMEs but scales rapidly into formal manufacturing with the right capital injection and branding strategy.

- Value Proposition: Focusing on artisanal quality, unique African designs, and leveraging ethical sourcing to capture premium, niche market segments both locally and internationally. The rise of e-commerce platforms allows SMEs to bypass traditional retail barriers and access global consumers directly.

II. Is Leather Business Profitable in Kenya?

The most critical question for any investor is the return on capital. The Kenyan government’s focus on industrialization has translated into highly attractive projections for the leather sector.

Quantifiable Investment Returns

According to market analyses and investment promotion agencies, the internal rate of return (IRR) for strategic investment in Kenya’s leather processing is highly competitive:

| Segment | Projected 10-Year Internal Rate of Return (IRR) | Market Value Projection (Kenya by 2040) |

| Footwear Factories | 25% | Over $500 million (Market Size) |

| Tanneries (Crust & Finished Leather) | 20% | Over $100 million (Annual Revenue Opportunity) |

These figures are predicated on increased domestic value addition and successful market penetration, particularly into large export markets where Kenya benefits from preferential trade agreements.

Value Addition Multiplier

Africa’s current challenge is exporting raw hides, which are then processed overseas and re-imported as finished goods. By investing at the mid-to-high point of the value chain, businesses capture significant economic returns:

- Raw Hide to Crust Leather: ~110% Value Added

- Raw Hide to Finished Leather: ~200% Value Added

- Raw Hide to Finished Leather Product (Footwear/Bag): Up to 320% Value Added

A dedicated, export-focused tannery with a capacity of 9 million square feet (a mid-scale operation) can generate steady-state annual revenue of over $11 million and an EBITDA margin of 19-34%, with a projected payback period of around six years, demonstrating robust profitability and scaling potential

III. The Cost for starting a Leather Business in Kenya

Starting a leather business can range from a few thousand shillings for a small artisan shop to millions of dollars for an industrial-scale plant. We present two comprehensive cost accounts to guide investment decisions, focusing on a Micro-Scale Artisan (low barrier to entry) and a Mid-Scale Manufacturer (investor-ready).

A. How much does a Micro-Scale Artisan Leather Business Cost (Kes)

This scenario is for the entrepreneur starting lean, focusing on high-quality, handcrafted goods sold via local markets and e-commerce.

| Item | Description | Estimated Cost (Ksh) |

| Fixed Assets (One-Time) | ||

| Leather Sewing Machine (Industrial/Heavy-Duty) | Used or basic new machine capable of thick leather | 65,000 – 130,000 |

| Hand Tools & Workbench | Knives, punches, skivers, cutting mats, hand press, basic bench | 30,000 – 60,000 |

| Licensing & Registration | Business name, KRA PIN, County Permit (e.g., Nairobi/Machakos) | 15,000 – 40,000 |

| Sub-Total Fixed Cost | 110,000 – 230,000 | |

| Working Capital (Initial 3 Months) | ||

| Initial Raw Material Inventory | Hides, skins, hardware (buckles, zippers), thread for first batch | 50,000 – 150,000 |

| Workshop Rent Deposit (2 Months) & Initial Utility | Small commercial space or dedicated home studio setup | 30,000 – 60,000 |

| Marketing & E-commerce (Website, Photography) | Basic online store setup and professional product photos | 20,000 – 50,000 |

| Sub-Total Working Capital | 100,000 – 260,000 | |

| TOTAL INITIAL CAPITAL REQUIRED | 210,000 – 490,000 (~ $1,600 – $3,770) |

B. How Profitable is a Mid-Scale Leather Goods & Footwear Factory (USD)

This scenario is for serious investors targeting regional or international markets, requiring automation and significant working capital. (Based on industry projections, 1 USD ≈ 130 KES, November 2025.)

| Expense Category | Minimum Initial Investment (USD) | Maximum Initial Investment (USD) | Targeting the Mid-Range |

| I. Capital Expenditures (CAPEX) | |||

| Essential Manufacturing Equipment | Fleshing machines, tanning drums, cutting presses, specialized stitching units | $30,000 | $150,000 |

| Workshop/Factory Space Fit-Out | Renovation, Electrical, Layout, Safety & QC area | $30,000 | $120,000 |

| Technology & Software | Accounting, ERP/Inventory Management Systems, POS | $5,000 | $25,000 |

| Sub-Total CAPEX | $65,000 | $295,000 | $180,000 |

| II. Working Capital & Operational Expenses (3-6 Months) | |||

| Initial Raw Material Inventory | Premium sourced finished/crust leather, hardware, soles | $15,000 | $70,000 |

| Initial Staffing & Payroll (3 Months) | Skilled artisans, designers, management, sales team | $40,000 | $150,000 |

| Marketing, Branding & Compliance | Professional brand identity, product photography, export certifications (REACH, AGOA) | $10,000 | $50,000 |

| Licensing, Legal & IP | Company registration, IP protection (Trademarks), Legal fees | $1,500 | $7,500 |

| Contingency Fund (15% of Subtotal) | $17,000 | $58,000 | |

| Sub-Total Working Capital | $83,500 | $335,500 | $240,000 |

| TOTAL ESTIMATED STARTUP CAPITAL | $148,500 | $630,500 | $420,000 |

This mid-scale investment range, roughly Ksh 19.3 million to Ksh 82 million, is necessary to achieve the quality and scale required for a 20%+ IRR, allowing the business to capture the value-added margin and participate in the lucrative export market.

IV. Is Kenya a good location for a leather business?

To be a go-to source for investors, one must address the macro environment. Kenya and Africa are deliberately creating an enabling environment to overcome historical challenges.

1. Enabling Infrastructure and Industrial Parks

The Kenyan government has made strategic investments to mitigate the challenge of high operating costs and environmental compliance.

- Kenanie Leather Industrial Park (KLIP): Located just 50km from Nairobi, KLIP is a key national priority. It offers a plug-and-play industrial zone designed specifically for leather processing, accommodating tanneries and leather goods manufacturers.

- Zero CAPEX on Effluent Treatment: Crucially, investors in KLIP benefit from shared, central Effluent Treatment Plants (ETPs), eliminating the massive capital expenditure and technical headache of environmental compliance that plagues traditional tanneries globally. This single factor significantly reduces the start-up cost and compliance risk for serious investors.

2. Market Access and Trade Agreements

The sector’s growth is secured by unparalleled duty-free access to major global markets:

- African Continental Free Trade Area (AfCFTA): By reducing tariffs and harmonizing policies across 55 countries, AfCFTA offers an immediate, unlimited $3.4 trillion continental market for finished leather and footwear products, eliminating competition from non-African imports.

- The US Market (AGOA): Duty-free access to the vast U.S. market via the African Growth and Opportunity Act (AGOA).

- The EU and UK Markets: Duty-free and quota-free access to both the European Union and the United Kingdom markets (Source 1.1).

3. Favorable Tax and Fiscal Policies

For investors setting up in Export Processing Zones (EPZs), the incentives are powerful:

- Tax Holidays: Up to a 10-year Corporate Income Tax holiday.

- Reduced Rates: A reduced corporate tax rate of 10% for the following 10 years, and 15% thereafter.

- Exemptions: VAT and customs duty exemption on imports and zero-rated VAT for local supplies, massively reducing the cost of importing machinery and specialized tanning chemicals.

V. Navigating the Challenges: Risks and Mitigation Strategies

While the opportunities are vast, investors must enter the market with eyes open to inherent challenges that require strategic management.

A. Raw Material Supply and Quality 🐐🐄

The Challenge: Despite having large herds, Kenya and many African nations suffer from raw hide and skin wastage and smuggling. Poor flaying and preservation techniques by small-scale abattoirs lead to low-quality raw material that fails to meet premium global standards.

Mitigation:

- Backward Integration: Engage directly with livestock farmers and abattoirs to implement better practices for hide preservation (e.g., standard suspension drying techniques).

- Advocacy: Support the government’s policy of maintaining high export levies on raw hides (like the 80% export levy) to ensure supply remains in-country for local value addition.

B. Skills and Technology Deficit 💡

The Challenge: The industry requires high-level technical expertise in chemical processing (tanning) and precision manufacturing (footwear design, lasting). A skills gap exists, leading to reliance on costly expatriate labor or outdated machinery.

Mitigation:

- Strategic Partnerships: Collaborate with international technical partners (e.g., from Italy or Turkey) for knowledge transfer and machinery training.

- Local Training: Leverage institutions like the Kenya Leather Development Council (KLDC) for formal training programs to build a skilled local workforce.

C. Environmental Compliance and Energy ♻️

The Challenge: Traditional tanning is chemically intensive. Outside of industrial parks, the cost and complexity of building and operating ETPs are prohibitive, and unreliable energy supply affects continuous production.

Mitigation:

- Location Strategy: Anchor the investment within established zones like the Kenanie Leather Industrial Park to utilize shared, specialized effluent infrastructure.

- Sustainability Focus: Invest in energy-efficient machinery and explore solar/biogas generation to mitigate the impact of unreliable grid electricity and future-proof the business against rising energy costs.

Conclusion

The narrative of African leather is rapidly shifting—from being a primary source of low-value, raw commodities to a producer of high-quality, finished luxury goods. Kenya’s ambition to grow the sector to $850 million by 2040 is underpinned by structural reforms and unparalleled investment incentives designed to overcome traditional constraints.

For the entrepreneur, the path lies in specialized leather goods, utilizing low entry barriers and high artisanal quality to serve the domestic market deficit. For the institutional investor, the opportunity rests in mid-to-large scale tannery modernization and footwear factories situated within strategic industrial zones, capturing the 20-25% IRR through export-oriented value addition.

The convergence of massive regional demand, preferential global trade access, and enabling infrastructure like the Kenanie Leather Industrial Park makes the African Leather and Footwear Sector not just profitable, but a necessary cornerstone investment for securing industrial leadership in the continent’s next phase of economic growth. The groundwork is laid; the market is ready; the next step is yours.