Are you considering investing in milk manufacturing business? The dairy sector in Africa, particularly in Kenya and East Africa, is experiencing a fundamental transformation, transitioning from a predominantly informal system to a robust, high-value formal market. For sophisticated entrepreneurs and investors, this transition presents a monumental opportunity, often referred to as the “White Gold Rush.” The sector in Kenya alone contributes between 3.8% and 4.5% of the national GDP and is anchored by an immense base of approximately 1.8 million smallholder households.

The critical gap, and therefore the lucrative investment opportunity, lies in value addition and formal processing. With the informal market still handling a staggering 80% to 85% of all milk produced, new, efficient processing and distribution businesses have a clear runway for growth. The national goal, exemplified by the Kenya Dairy Industry Sustainability Roadmap 2023–2033, aims to double annual milk output to 10 billion litres and increase the percentage of formally marketed milk to 50%.

This post serves as the definitive guide—the go-to source—for understanding the businesses involved, the true cost of entry, and the powerful profitability levers within the African dairy value chain.

1. Best Business Ideas in Kenya’s Dairy Value Chain

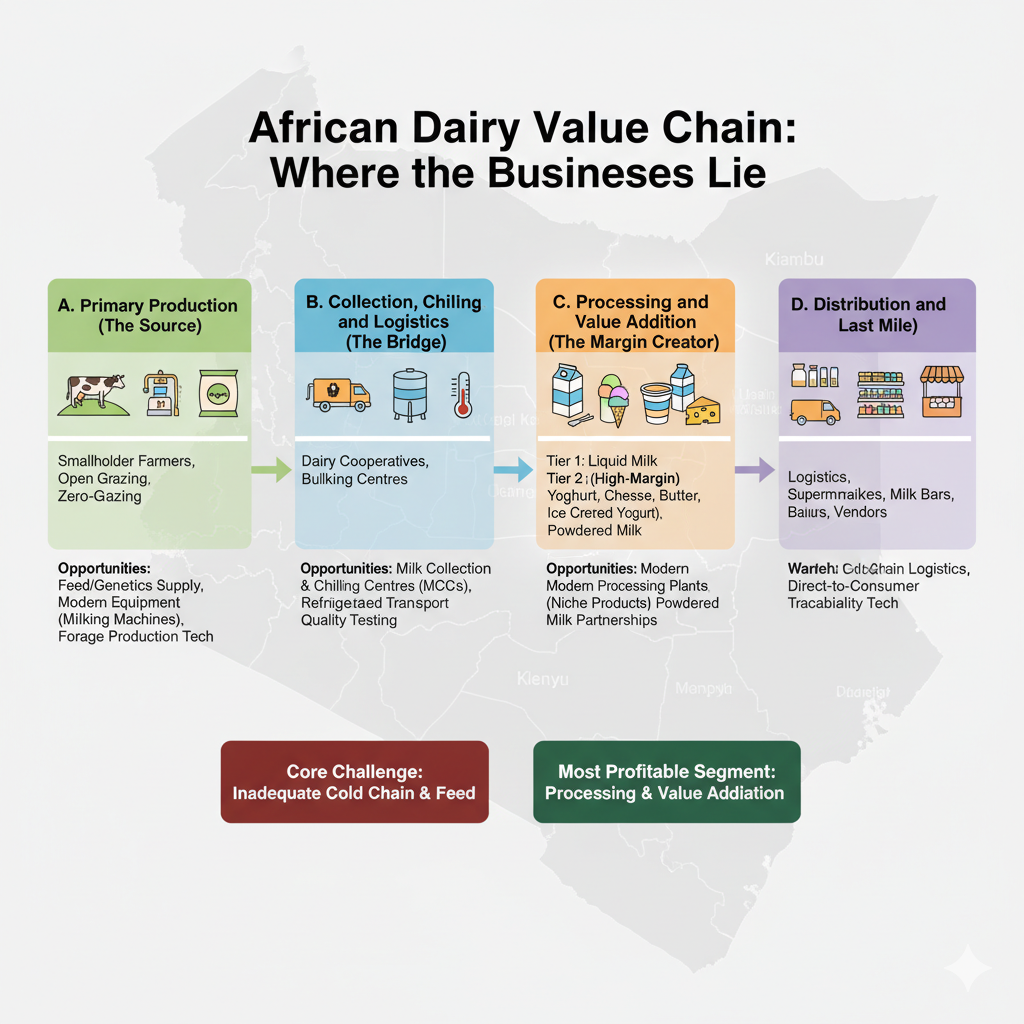

The dairy industry is a complex, multi-tiered ecosystem, offering diverse entry points for investment, far beyond mere farming. The chain can be segmented into four key stages:

A. Primary Production (The Source)

This is the foundation of the industry, where raw milk is produced. In Kenya, this stage is dominated by smallholder farmers.

- Business Model: Small-scale (1-5 cows) to large commercial dairy farming. Production systems range from traditional open grazing to high-yield intensive (zero-grazing) systems.

- Investment Opportunities: Investing in input supply businesses (feed and genetics), modern farm equipment (milking machines, starting from KES 50,000 to KES 150,000 for basic models), and extension services focusing on high-quality forage production and mechanisation practices. The core challenge here is inadequate feed and disease prevalence, creating a demand for technology-based solutions.

B. Collection, Chilling, and Logistics (The Bridge)

Milk is extremely perishable, making the cold chain the most critical link between the farm and the factory.

- Business Model: Dairy Cooperatives and Bulking Centres are the primary actors. These businesses invest in bulk collection tanks, quality testing equipment, and milk chillers.

- Investment Opportunities: Setting up Milk Collection and Chilling Centres (MCCs) in high-production areas (like Kiambu, Meru, Nyeri, and Uasin Gishu in Kenya). These centers aggregate milk from smallholders, test for quality (a critical safety issue), and chill it for transport. This segment provides jobs for quality testers, collection managers, and refrigerated transport drivers. Inadequate cold chain infrastructure remains a major challenge, signaling a prime area for infrastructure investment.

C. Processing and Value Addition (The Margin Creator)

This stage transforms raw, perishable milk into safe, stable, high-margin products. This is the most profitable segment of the value chain.

- Business Model: Companies here focus on pasteurisation and UHT treatment for liquid milk, and manufacturing various dairy products.

- Key Products and Margin Potential:

- Tier 1 (High Volume/Medium Margin): Pasteurized and UHT (Long-life) Milk.

- Tier 2 (Value-Added/High Margin): Yoghurt (plain, flavoured, drinking), Cheese (Mozzarella, Cheddar, local varieties), Butter/Ghee, Ice Cream, and finally, Powdered Milk. Diversifying into these value-added products is key to commanding higher margins.

- Investment Opportunities: Acquiring and installing modern processing equipment, specializing in a high-demand niche product (e.g., Probiotic, Greek Yogurt), or entering the market by partnering with existing processors to set up powdered milk plants. Kenya has 32 active processors and 186 small processors, with an estimated capacity of about 3.75 million liters per day.

D. Distribution and Retail (The Last Mile)

This stage ensures the processed product reaches the consumer.

- Business Model: Logistics companies handle bulk distribution to wholesalers and retailers (supermarkets, shops). The informal sector, comprised of vendors and milk bars, still plays a significant role in last-mile access, especially in rural areas.

- Investment Opportunities: Investing in cold-chain logistics (refrigerated vans), developing efficient warehousing solutions, and creating technology platforms for direct-to-consumer delivery or optimizing supply chain traceability.

2. Is Dairy Business a Profitable Business Idea in Kenya?

In short, yes, dairy is highly profitable when efficiency and value addition are prioritized.

Profitability at the Farm Level

Even at the production level, the business generates strong cash flow. A well-managed 10-cow dairy farm in Kenya can yield a monthly net profit ranging from Ksh 185,000 to Ksh 260,000 (approx. USD 1,233 to USD 1,733, based on an approximate rate of 1 USD = 150 KES). Depending on the initial investment, such a farm can reach its break-even point in as little as 8 to 25 months.

However, the major leverage for investors lies at the processing stage.

Profitability at the Processing Level (The High Margin Zone)

For processing and distribution, profitability is driven by two main factors: capacity utilization and product mix.

- High Net Profit Margins: Benchmarks for sophisticated large-scale dairy processing show the potential for a Net Profit Margin of 30% by year five.

- Revenue Breakdown: For processed milk, the channel cost structure typically allocates a significant portion to raw milk, followed by processing, packaging, and operating expenses, with the remaining percentage being the margin. The key to maximizing this margin is minimizing inefficiencies (which currently cost smallholder producers an estimated 40% of potential profit) and increasing the proportion of value-added products.

- Competitive Advantage: New entrants focused on efficiency—by ensuring compliance, utilizing better quality control, and reducing waste through technology—can rapidly gain market share, particularly by capturing demand in the formal segment, which is expanding rapidly due to urbanisation.

3. The Cost for Starting a Mid-Scale Dairy Processor

For an investor seeking significant returns, the focus should be on establishing a mid-scale processing facility (Mini-Dairy) capable of processing 5,000–10,000 litres per day and producing pasteurised milk and basic yogurt.

The total capital investment for a small-scale milk processing unit can range from $50,000 up to $1,000,000, depending on scale and level of automation. A robust, mid-range investment (approximately $550,000 or Ksh 82.5 Million) is detailed below to serve as a benchmark. (Note: Exchange rate used for illustration: 1 USD ≈ 150 KES).

Table 3.1: Estimated Cost Account for a Mid-Scale Dairy Processing Unit (Approx. 5,000 L/Day Capacity)

| Cost Category | Sub-Category | Estimated CAPEX (Ksh) | Estimated CAPEX (USD) | Notes & Details |

| I. Capital Expenditure (CAPEX) | ||||

| Land & Infrastructure | Land/Lease Premium (1 acre, peri-urban) | Ksh 15,000,000 | $100,000 | Highly variable. Lease/renting is an initial alternative. |

| Factory Building/Renovation (1,000 sq. m) | Ksh 22,500,000 | $150,000 | Non-slip floors, drainage, separate processing/storage areas. | |

| Utility Installation (Water/Electricity/Drainage) | Ksh 4,500,000 | $30,000 | Includes backup systems and boreholes. | |

| Processing Equipment | Milk Collection/Storage Tanks (10,000 L) | Ksh 7,500,000 | $50,000 | Stainless steel chilling and storage facilities. |

| Pasteuriser/Homogeniser (5,000 L/day) | Ksh 15,000,000 | $100,000 | Essential for formal sector milk safety and quality. | |

| Small Packaging Line (Sachets/Bottles) | Ksh 6,000,000 | $40,000 | Automation improves efficiency and hygiene. | |

| Ancillary & Logistics | Quality Assurance Lab & Testing Kits | Ksh 3,000,000 | $20,000 | Essential for KDB compliance and quality control. |

| Refrigerated Distribution Vehicle (1 Unit) | Ksh 4,500,000 | $30,000 | Necessary for maintaining the cold chain during distribution. | |

| Sub-Total CAPEX | Ksh 78,000,000 | $520,000 | ||

| II. Regulatory & Initial Operating Costs (Initial OPEX) | ||||

| Regulatory & Licensing | Kenya Dairy Board (KDB) Licensing & Permits | Ksh 500,000 | $3,333 | Preliminary inspection, application, and annual license fees. |

| County Government Business Permit | Ksh 150,000 | $1,000 | Local operating license. | |

| Environmental & Waste Management Permits | Ksh 200,000 | $1,333 | Compliance with NEMA and local waste disposal standards. | |

| Initial Working Capital (1 Month) | Raw Milk Procurement (5,000 L/day x 30 days) | Ksh 7,500,000 | $50,000 | Assuming KES 50/L raw milk price. The single largest cost. |

| Staff Salaries (Management, QA, Labor) | Ksh 600,000 | $4,000 | For 15-20 staff across production and logistics. | |

| Utilities, Cleaning & Packaging Materials | Ksh 1,500,000 | $10,000 | Packaging costs are a key input. | |

| Sub-Total Initial OPEX/Working Capital | Ksh 10,450,000 | $69,666 | ||

| TOTAL INITIAL INVESTMENT | Ksh 88,450,000 | $589,666 |

Key Ongoing Operating Expenditure (OPEX)

The long-term profitability hinges on managing the ongoing variable costs:

- Raw Milk Procurement: This is the most significant cost component, representing up to 42% of the unit retail price. Sourcing quality milk reliably and at a good price (currently around KES 50 per litre for farmers) is paramount.

- Energy Costs (Utilities): High costs for refrigeration, pasteurisation, and steam generation require energy-efficient equipment and backup power systems.

- Packaging Costs: Efficient packaging lines and materials are a crucial component of the product cost structure.

- Labor and Maintenance: Ongoing costs for technical staff, maintenance of sophisticated machinery, and cleaning supplies.

4. Regulatory Compliance in Kenya’s Dairy Business

To run a profitable milk processing factory, it is essential to understand and comply with the regulatory environment, for operational planning and compliance costs. The regulatory burden is particularly challenging at the county level, is a known challenge for manufacturers. Below are the key considerations

The Kenya Dairy Board (KDB)

The KDB is the central regulator responsible for the supervision, regulation, and promotion of the dairy industry in Kenya. Any serious formal processing and distribution business must comply with KDB requirements, including:

- Licensing: Obtaining a processor’s license requires a preliminary inspection of the premises at least two months before the application. This ensures compliance with food safety and hygiene standards.

- Milk Carriage Permits: Specific permits are required to legally transport milk, especially raw bulk milk, to ensure it meets regulatory frameworks.

- Quality Assurance: Compliance with national food safety and quality standards is non-negotiable to build consumer trust and access formal retail chains.

County-Level and Environmental Compliance

In addition to national KDB licensing, county governments require specific business permits to operate legally. Regulatory compliance is complex, as evidenced by reports such as the Kenya Association of Manufacturers (KAM) Regulatory Audit Survey, which details the various Legal, Regulatory And Institutional Frameworks in Selected Counties and across different industrial sectors, including the Food and Beverage Sector. Investors must conduct thorough due diligence on county-specific levies, fees, and operational permits, as these can vary significantly and influence the final setup cost and ongoing OPEX.

5. Is milk Processing a good business idea Now?

The African dairy market is driven by demographic and economic fundamentals that promise sustained growth:

High Per Capita Consumption and Demand-Supply Gap

Kenya already boasts the highest per capita milk consumption in Sub-Saharan Africa, and this demand is projected to rise significantly with a growing population and rapid urbanisation. The current domestic production level meets only about half of the estimated domestic demand (estimated at 8 billion litres), leading to a reliance on imports. This fundamental demand-supply gap guarantees a market for increased domestic processing capacity.

The Value Addition Imperative

The largest financial returns are in value addition. Opportunities abound in sophisticated products like:

- Powdered Milk: Offers long shelf-life and is crucial for balancing supply during seasonal gluts and meeting international/regional export demand.

- Specialty Products: Organic, fortified, and specialty products (e.g., Greek yogurt or local cheese varieties) cater to the expanding African middle class and enable processors to differentiate their brand, capture higher price points, and lock in greater profitability.

- Export Potential: Kenya has an estimated export potential of USD 9.7 billion across regional blocs like EAC, COMESA, and ECCAS, and target destinations like the Gulf Cooperation Council (GCC) countries. Investing in UHT and powdered milk facilities is the gateway to unlocking this export revenue.

Conclusion

The dairy sector in Kenya and Africa is moving into its golden age. The opportunity is not simply to produce milk, but to establish technologically advanced, compliant, and efficient processing and distribution enterprises that capture the 80% of milk currently flowing through informal, low-margin channels. The initial capital investment for a robust, mid-scale processor is substantial, requiring around $590,000 (Ksh 88.5 Million), but the projected net profit margins of up to 30%, coupled with the certainty of a demand-led market, make this a compelling case for patient capital and visionary entrepreneurship. Investments in technology, logistics, and compliance are the keys to building a go-to brand that will dominate the next generation of African dairy.