Are you looking to invest in the Food and Beverage (F&B) business in Kenya or the broader African continent? The F&B industry is the fastest growing sector, fueled by a booming middle class, rapid urbanization, and a youth-driven demand for convenience and quality. This opportunity is creating many ideas for local entrepreneurs and global investors like you.

In this guide, you will learn the most profitable food business ideas, critical cost analysis and other select dynamics of Africa’s fastest-moving consumer goods market.

Is there a Business Opportunity on Africa’s Food and Beverage

The narrative of African economic growth is inextricably linked to its consumer market, with F&B serving as the bedrock. Demographic trends alone guarantee growth: the continent is young, urbanizing rapidly, and possesses a growing middle class with increasing disposable income.

Market Size and Growth Projections

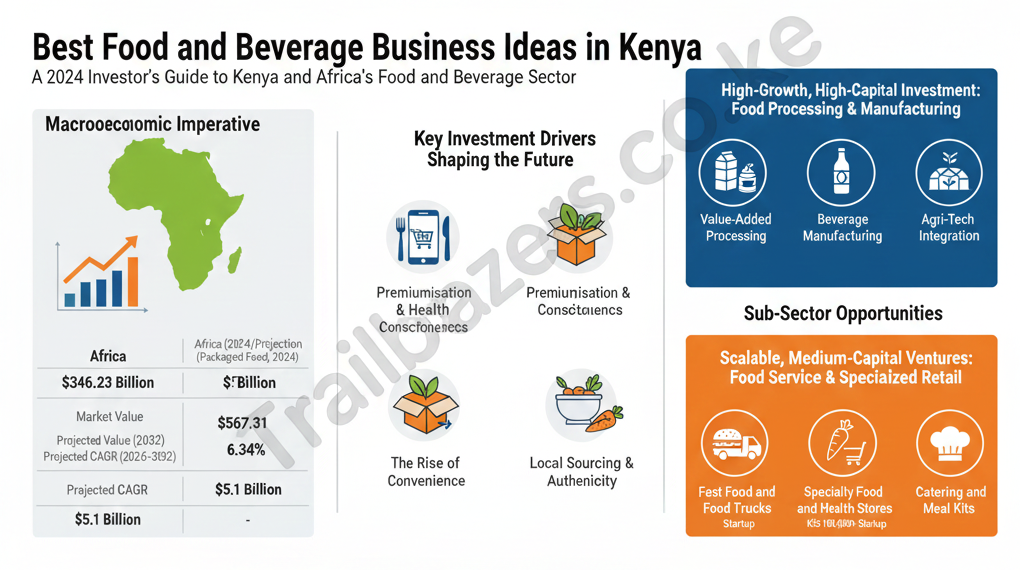

The African Food and Beverage Market is a massive, high-growth frontier. It was valued at approximately $346.23 Billion in 2024 and is projected to surge to $567.31 Billion by 2032. This expansion is forecasted to sustain a Compound Annual Growth Rate (CAGR) of 6.34% between 2026 and 2032.

In this landscape, Kenya stands out as an East African powerhouse. Its packaged food sales reached $5.1 billion in 2024, positioning it as the regional leader. This dominance is driven by an expanding middle class and the modernization of its retail infrastructure, notably the spread of supermarkets.

| Market Metric | Africa (2024/Projection) | Kenya (Packaged Food, 2024) |

| Market Value | $346.23 Billion (2024) | $5.1 Billion |

| Projected Value (2032) | $567.31 Billion | – |

| Projected CAGR (2026-2032) | 6.34% | – |

| Dominant Segment | Food (65% to 70% of total market value) | – |

Key Investment Drivers Shaping the Future

- The Rise of Convenience: Urban lifestyles mean consumers have less time for traditional meal preparation, driving explosive demand for convenience products. This includes ready-to-eat meals, packaged snacks, meal kits, and single-serve beverages. Manufacturers are responding by heavily investing in innovative, portable packaging solutions.

- Premiumisation and Health Consciousness: African consumers, particularly in the middle and upper classes, are increasingly willing to pay a premium for products associated with quality, authenticity, and health. There is a skyrocketing demand for:

- Functional Beverages (e.g., kombucha, fortified drinks).

- Organic and Plant-Based Products.

- Minimally Processed Snacks with added nutrients.

- Digital Distribution: E-commerce and mobile-first food delivery services are revolutionizing distribution, especially in urban centers. Brands must build a strong online presence to capitalize on this shift.

- Local Sourcing and Authenticity: Consumers are actively seeking out products featuring local and authentic African flavors. Ingredients like baobab, sorghum, and fonio are becoming commercialized, offering opportunities for brands that prioritize cultural authenticity.

Best Business Ideas in Africa’s Food and Beverage Sector

The F&B sector is diverse, offering a spectrum of investment opportunities categorized by required capital and scalability.

I. Food Processing & Manufacturing

This segment targets the massive demand for packaged goods and imports substitution. Investment here focuses on infrastructure, technology, and compliance.

- Value-Added Processing: This involves converting raw agricultural produce into higher-margin packaged goods. Examples include dairy processing (milk, yogurt), fruit/vegetable canning, high-quality milling, and preparing frozen ready-to-eat meals.

- Beverage Manufacturing: While highly competitive, the beverage sector is highly profitable. Opportunities exist in specialty coffee/tea, craft beverages (using local ingredients), and the rapidly growing functional drinks market.

- Agri-Tech Integration (Vertical Farming): High-tech, controlled-environment agriculture startups are addressing supply chain constraints and year-round demand for high-value produce.

II. Food Distribution Services & Specialized Retail

These businesses require strategic location, strong branding, and efficient supply chain management.

- Fast Food and Food Trucks (KSh 200,000+ Startup): The fast-food market is booming in Kenya’s urban centers. Success hinges on incorporating popular local dishes alongside international staples, focusing on high-traffic areas, and offering excellent service.

- Specialty Food and Health Stores (KSh 100,000+ Startup): Catering to the health-conscious consumer with imported specialty items, organic produce, or niche dietary products (e.g., gluten-free, keto-friendly).

- Catering and Meal Kits: Leveraging culinary skills for corporate catering or subscription-based meal kit services.

III. Low-Capital Food Shops (Vibandas)

For the starting entrepreneur, Kenya offers numerous entry points that require minimal capital but provide essential operational experience and high margins.

| Business Idea (Kenya) | Estimated Startup Capital (KES) | Approximate USD Equivalent* | Strategy |

| Mandazi/Chapati Production | KSh 5,000 – KSh 30,000 | $40 – $230 | Focus on bulk sales to local markets, offices, or home delivery. |

| Fresh Juice Stalls | KSh 20,000 – KSh 50,000 | $150 – $380 | High-traffic area, targeting health-conscious consumers (gyms, parks). |

| Roasted Meat/Snacks (Kebab, Sausage Shawarma, Mutura) | KSh 10,000 – KSh 50,000 | $75 – $380 | Vending carts in busy street corners or events. |

| Homemade Ice Cream/Confectionery | KSh 20,000 – KSh 50,000 | $150 – $380 | Experiment with unique flavors and leverage online platforms. |

*USD conversion based on KES 130 to 1 USD for estimation purposes.

Profitability and Financial Dynamics

The F&B industry offers robust returns, but profitability is tightly bound to disciplined cost management and scalable operations.

Understanding Food Cost Percentage (FCP)

Here is a clean, sharply formatted, and highly legible version. You can paste this directly into your article or report.

Food Cost Percentage (FCP) in Kenya’s Prepared Food Businesses

For restaurants, catering companies, and quick-service outlets, Food Cost Percentage (FCP) is the single most important profitability metric. It shows how much of each shilling earned goes directly to ingredients.

The formula to calculate your FCP is;

FCP = (Ingredient Cost / Selling Price) × 100

A healthy FCP for Kenyan food businesses typically falls between 28% and 35%. Staying within this zone allows a business to cover overheads—rent, labour, utilities—and still generate a solid profit.

| Expense Item | Cost (KSh) |

|---|---|

| Beef Patty (200g) | 200.00 |

| Burger Bun | 50.00 |

| Lettuce, Tomatoes, Sauce | 60.00 |

| Total Ingredient Cost | 310.00 |

| Selling Price | 1,200.00 |

| Food Cost Percentage | 25.8% |

Calculation

FCP = (310 / 1,200) × 100 = 25.8%

Interpretation

An FCP of 25.8% signals excellent gross margin, well below the 28–35% industry range. This suggests the menu item is priced strongly and leaves enough room for:

- Overhead recovery (rent, wages, utilities)

- Marketing and packaging costs

- Profitability after operational expenses

Why FCP Matters to Investors

Investors should assess:

- How consistently a business maintains its FCP

- Strategies used to reduce ingredient volatility

- Seasonal menu adjustments

- Supplier diversity and bulk purchasing

- Recipe control and portion discipline

Low or stable FCP often reflects a well-run, scalable food business.

How to boost profits for food entrepreneurs

- Vertical Integration: Companies that control their supply chain, from farm to fork, can significantly reduce raw material costs and ensure consistent quality.

- Branding and Premiumisation: Investing in strong branding allows a company to charge higher prices, moving the product from a commodity to a premium item, thus improving profit margins.

- Operational Efficiency: The shift toward technology (e.g., POS systems, inventory management software) is essential for real-time cost control, waste reduction, and inventory management, all of which directly impact the bottom line.

What is the Cost of starting a food packaging factory in Kenya

To provide a tangible view of the investment required, we model the startup costs for a Mid-Scale Packaged Snack Production Company—a business focusing on processing and packaging healthy, local-ingredient snacks (e.g., dried fruit, fortified snack bars) for distribution to supermarkets and online channels. This model balances the low-capital entry of street food with the high-capital demands of large-scale manufacturing, offering a sweet spot for scalable investment.

Scenario: Chakula Bora (Good Food) Ltd. – A startup launching a range of locally-sourced, packaged healthy snacks in Nairobi, Kenya.

| Category | Item Description | Estimated Cost (KES) | Estimated Cost (USD) | Notes and Key Considerations |

| A. Statutory & Regulatory Setup | Crucial for credibility and scaling | |||

| 1. Company Registration | Name Search, Registration Fee, Stamp Duty (Min. Capital) | KES 15,000 | $115 | Registration starts at KES 10,000. |

| 2. Single Business Permit (County) | Nairobi License (Small Factory/Processing) | KES 50,000 | $385 | Cost varies by county and business size. |

| 3. Health/Fire Safety Certificates | Inspection and compliance fees | KES 20,000 | $155 | Required for food handling premises. |

| 4. KEBS/Food Safety Certification | Kenya Bureau of Standards/CAC testing and initial licensing | KES 150,000 | $1,155 | Essential for market entry and investor trust. |

| SUB-TOTAL A (Registration) | KES 235,000 | $1,805 | ||

| B. Capital Expenditure (CAPEX) | Focus on scalable, quality equipment | |||

| 5. Commercial Mixer/Processor | Mid-range, industrial-grade equipment | KES 300,000 | $2,308 | Dependent on product (e.g., dehydrator, oven, grinder). |

| 6. Packaging & Sealing Machine | Semi-automatic vertical form fill seal (VFFS) machine | KES 450,000 | $3,462 | Key to efficiency and professional product presentation. |

| 7. Refrigeration/Storage Unit | Commercial-grade cold/dry storage | KES 150,000 | $1,154 | |

| 8. Workshop/Processing Layout | Kitchen fitting, stainless steel tables, ventilation | KES 250,000 | $1,923 | |

| SUB-TOTAL B (CAPEX) | KES 1,150,000 | $8,847 | ||

| C. Operations & Launch Costs | Critical for initial market penetration | |||

| 9. Initial Inventory (Raw Materials) | Bulk purchase of fruits, nuts, binding agents for 1st month | KES 200,000 | $1,538 | |

| 10. Packaging Materials | Custom branded sachets/pouches (1st batch) | KES 150,000 | $1,154 | Branding is vital in packaged goods. |

| 11. Facility Lease Deposit | 3 months deposit on a processing space (KES 50k/month rent) | KES 150,000 | $1,154 | Location choice impacts rental cost. |

| 12. Branding and Marketing Launch | Logo, website/social media presence, launch campaign | KES 100,000 | $769 | Essential for establishing a premium brand identity. |

| 13. Staffing & Training (1st Month) | Salaries for 3-4 staff (incl. trainer/consultant) | KES 150,000 | $1,154 | |

| 14. Contingency Buffer (20% of OpEx) | Unforeseen costs, utility deposits, minor repairs | KES 150,000 | $1,154 | |

| SUB-TOTAL C (OpEx) | KES 850,000 | $6,538 | ||

| TOTAL INITIAL INVESTMENT | (A + B + C) | KES 2,235,000 | $17,190 |

Note: Exchange rate assumed KES 130 to 1 USD.

Managing Risks and Future-Proofing Investment

While the market is lucrative, it is not without challenges. Investors and entrepreneurs must prepare for:

- Supply Chain Fragmentation: Deficiencies in cold chain logistics and inter-country distribution networks remain a constraint, especially for perishable goods. Investment in robust logistics and local sourcing is crucial.

- Currency Volatility: Fluctuating currency rates and inflation can rapidly erode household purchasing power and increase the cost of imported raw materials or equipment.

- Competition: The market is fiercely competitive. Product differentiation, whether through unique local ingredients, sustainability credentials, or innovative functional attributes, is vital for success.

The future of F&B in Kenya and Africa is defined by two key factors: innovation in product offering (health, local ingredients) and efficiency in distribution (digital platforms, modern retail). By focusing investment on value-addition, mastering operational costs (as shown in the mock account), and aligning with the continent’s evolving consumer preferences, the Food and Beverage sector offers some of the most compelling returns available globally today.

For those interested in the detailed financial projections for the fast-food segment, this video provides a revenue and profit breakdown. Cost Breakdown of Starting a Fast Food Business/ Revenue and Profit Projections #fastfoodbusiness.