Are you wondering if the Kenyan Textile and Apparel Sector makes profit?

Kenya is the continent’s leading apparel and textile exporter under the African Growth and Opportunity Act (AGOA). The textile and apparel (T&A) sector in Kenya is not just a legacy industry; it is the cornerstone of the nation’s industrialization blueprint, holding a privileged position within the government’s ambitious Vision 2030 and the recent push for manufacturing growth. For entrepreneurs and investors across Africa, Kenya presents a uniquely leveraged gateway—combining preferential market access, a youthful, skilled workforce, and comprehensive investment incentives.

This comprehensive guide will help you to understand the actual costs, profitability and the strategic advantages of venturing into Kenya’s dynamic Textile and Apparel (T&A) value chain.

I. Top Business Ideas in Kenya’s Textile and Apparel Sector

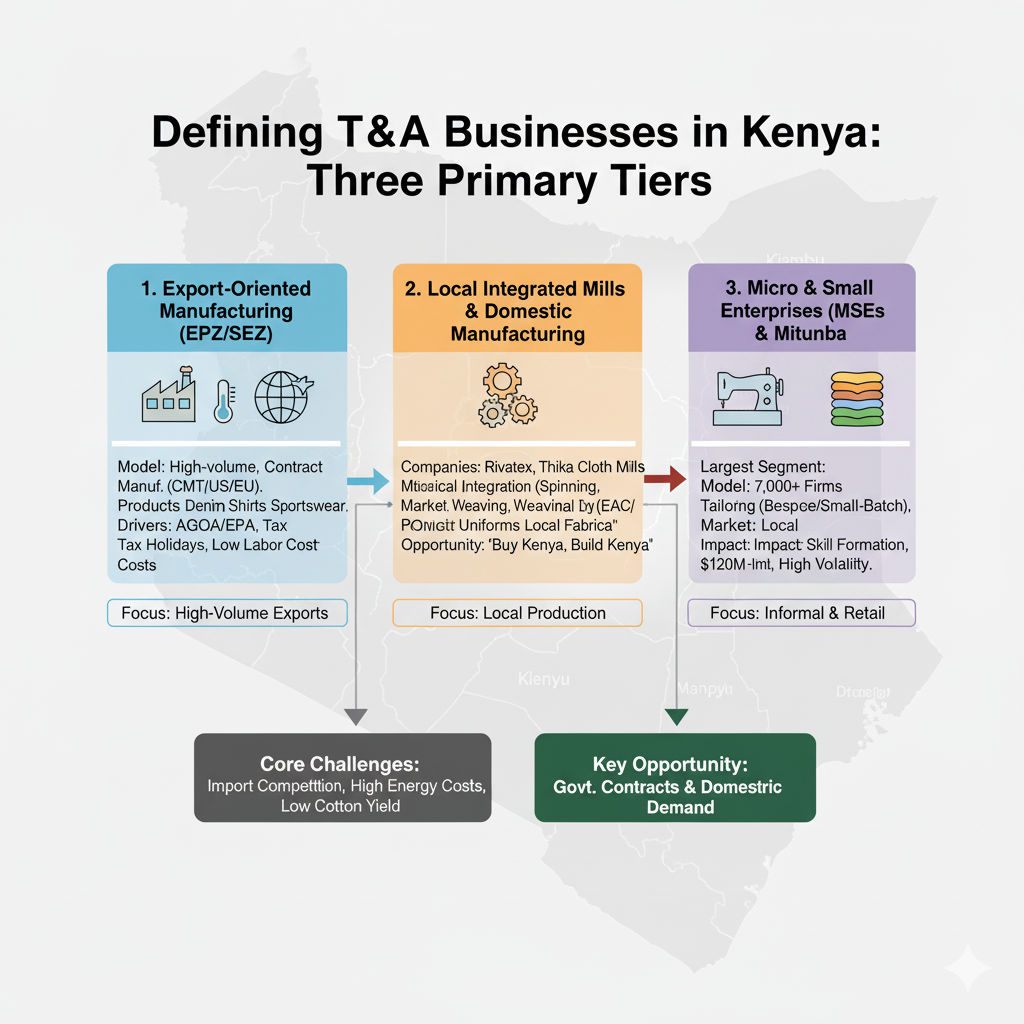

The Kenyan T&A sector is a complex ecosystem divided into three primary tiers, each with distinct capital requirements, operational models, and target markets.

A. The Three Tiers of the T&A Value Chain

1. Export-Oriented Manufacturing (EPZ/SEZ)

These are large-scale, often foreign-owned, garment manufacturing companies operating within Export Processing Zones (EPZ) or Special Economic Zones (SEZ). They are the engine of Kenya’s export success, focusing on high-volume, contract manufacturing for major global brands (like H&M, Walmart, and Levi’s) targeting the US and European markets.

- Business Model: Cut, Make, and Trim (CMT) or Full Package (FP). Production is focused almost entirely (up to 95%) on international markets.

- Key Products: Denim, women’s cotton trousers, knit shirts, and sportswear.

- Drivers: Preferential trade agreements (AGOA, EPA), fiscal incentives (tax holidays), and low labor costs.

2. Local Integrated Mills and Domestic Manufacturing

This tier involves mid-to-large-scale companies like Rivatex East Africa Limited and Thika Cloth Mills. These companies aim for vertical integration—from spinning yarn to weaving, knitting, dyeing, and finishing fabric. They primarily supply the domestic and regional (EAC/COMESA) markets, often specializing in institutional wear (uniforms) and high-quality local fabrics.

- Challenges: Firms in this segment face intense competition from cheap imported Asian textiles and garments, high costs of energy, and the need to import high-quality cotton fiber and chemicals to meet demand, despite Kenya’s cotton farming potential. Capacity utilization in many older mills remains below 50%.

- Opportunity: The “Buy Kenya, Build Kenya” initiative and government contracts offer significant opportunities for this segment to scale.

3. Micro and Small Enterprises (MSEs) and the Mitumba Market

This is the largest segment by employment, comprising over 70,000 micro and small firms. This includes independent tailors, local fashion designers, boutique manufacturers, and the vast second-hand clothing (Mitumba) market.

- Business Model: Tailoring for bespoke orders, small-batch fashion lines, repairs, and customization. The Mitumba market provides highly affordable clothing and generates significant economic activity (contributing over $120 million annually).

- Investment Profile: Low capital investment, high volatility, and reliance on local market demand. This segment is crucial for skill formation and absorbing a large, young workforce.

II. What is the Cost of Starting a Small Tailoring Business in Kenya

Determining the exact cost to start a T&A business requires defining the scale. The investment gap between starting a small tailoring unit and launching a modern, automated EPZ factory is enormous. Below is a mock cost account detailing the required initial capital for three distinct investment scales.

Note on Currency and Costs:

- Costs are presented in both US Dollars (USD) and Kenyan Shillings (KES).

- The exchange rate is approximated for illustrative purposes (e.g., 1 USD ≈ 130 KES, subject to market fluctuations).

- These figures represent initial capital investment (CAPEX), excluding operational working capital (OPEX) for the first 6-12 months.

Mock Cost Account: Initial Capital Investment

| Cost Component | I. Large-Scale EPZ/Integrated Plant (1000+ Workers) | II. Mid-Scale Local Garment Factory (50-100 Workers) | III. Micro-Scale Tailoring Unit (1-5 Workers) |

| I. FIXED CAPITAL (CAPEX) | |||

| Land & Building/Lease | Purchase or long-term lease of 10,000+ sqm industrial shed (EPZ). | Lease/Fit-out of a 500 sqm commercial space (Nairobi/Mombasa). | Rental deposit for a small shop/kiosk (2-3 months rent). |

| Estimated Cost (USD) | $1,500,000 – $8,000,000 | $30,000 – $150,000 | $500 – $1,500 |

| Estimated Cost (KES) | KSh 195M – KSh 1.04B | KSh 3.9M – KSh 19.5M | KSh 65,000 – KSh 195,000 |

| Machinery & Equipment | Full production line: Automated cutters, industrial sewing machines (500+), finishing/dyeing equipment, boiler systems. | 50 industrial sewing machines (lockstitch, overlock, buttonhole), cutting tables, steaming/pressing units. | 2-3 standard industrial sewing machines, 1 overlock machine, iron/board. |

| Estimated Cost (USD) | $800,000 – $5,000,000 | $25,000 – $70,000 | $1,000 – $3,500 |

| Estimated Cost (KES) | KSh 104M – KSh 650M | KSh 3.25M – KSh 9.1M | KSh 130,000 – KSh 455,000 |

| Technology & Software | ERP/SCM systems, CAD/CAM for pattern making, logistics software. | Inventory management and basic accounting software. | Basic Point-of-Sale (POS) system or smartphone application. |

| Estimated Cost (USD) | $50,000 – $250,000 | $1,000 – $5,000 | $100 – $500 |

| Estimated Cost (KES) | KSh 6.5M – KSh 32.5M | KSh 130,000 – KSh 650,000 | KSh 13,000 – KSh 65,000 |

| II. STARTUP/PRE-OPERATIONAL EXPENSES | |||

| Legal & Licensing | EPZ license fee, NEMA EIA, company incorporation, and local permits. | Business name registration, KRA PIN, County Business Permit (Single Business Permit). | Business name registration and County Business Permit. |

| Estimated Cost (USD) | $20,000 – $100,000 | $500 – $3,000 | $100 – $300 |

| Estimated Cost (KES) | KSh 2.6M – KSh 13M | KSh 65,000 – KSh 390,000 | KSh 13,000 – KSh 39,000 |

| Initial Inventory/Raw Materials | Bulk import of fabric, yarn, trims (container loads) for first 3-6 production cycles. | Purchase of fabric rolls, thread, and accessories for initial orders (local and imported). | Purchase of fabric bundles and notions for 20-50 initial garments. |

| Estimated Cost (USD) | $500,000 – $1,500,000 | $10,000 – $30,000 | $300 – $1,000 |

| Estimated Cost (KES) | KSh 65M – KSh 195M | KSh 1.3M – KSh 3.9M | KSh 39,000 – KSh 130,000 |

| TOTAL INITIAL INVESTMENT | $2,870,000 – $14,850,000+ | $61,500 – $258,000 | $2,000 – $6,800 |

| Total KES (Approximate) | KSh 373M – KSh 1.93 Billion+ | KSh 8M – KSh 33.5M | KSh 260,000 – KSh 884,000 |

The data confirms that starting a medium-to-large-scale integrated textile factory (Tier I and II) is a capital-intensive venture, often requiring well over KSh 500 million ($3.8 million) for initial investment, equipment, and working capital in the first year. For a high-volume garment manufacturing EPZ, the initial capital outlay can easily exceed KSh 1 Billion ($7.7 million).

III. is Kenya’s Textile and Apparel Business Profitable?

Is the Kenyan T&A sector profitable? The answer is a definitive yes, provided the business model is strategically aligned with the correct market niche and leverages Kenya’s competitive advantages.

A. The Export Profit Engine: Leveraging AGOA

Profitability in the Kenyan T&A sector is heavily skewed towards the export market, driven primarily by the African Growth and Opportunity Act (AGOA).

- Duty-Free Access: AGOA allows Kenyan-manufactured apparel to enter the lucrative United States market duty-free and quota-free. Since the US garment tariff can be as high as 32%, this exemption translates directly into massive profit margins and price competitiveness for Kenyan exporters compared to non-AGOA countries. Kenya is the largest single exporter of garments under AGOA, with annual exports nearing $600 million USD.

- Cost Competitive Production: Kenya’s competitive advantage lies in its labor force. It boasts a large, youthful, and highly trainable workforce with competitive labor costs compared to major Asian manufacturers. Furthermore, Kenya’s power generation is approximately 93% renewable, offering a green, sustainable manufacturing advantage that appeals to international brands seeking to reduce their environmental footprint.

B. The Domestic Market Challenge and Resilience

Firms targeting the local market (Tier II and III) face a more challenging, albeit rewarding, financial landscape.

- Cost Drivers: The main constraints on local profitability are high operational costs, especially the high cost and inconsistent supply of electricity and the cost of importing raw materials (yarn and high-quality fabric).

- Intense Competition: The local market is flooded with inexpensive, high-volume imports, particularly from China, as well as the thriving Mitumba (second-hand) market, which supplies garments at prices local manufacturers often cannot match.

- The Niche Strategy: Successful local firms tend to carve out profitable niches by specializing in uniforms, protective wear (PPE), specialized knitting/weaving, or high-end bespoke fashion where quality and local cultural appeal justify higher price points. A recent study confirmed that for all textile and apparel firms in Kenya, effective cash management is a crucial determinant of profitability, accounting for nearly 67% of the variance in financial performance.

Profitability Snapshot

| Segment | Primary Market | Profit Driver | Risk Factor | ROI Potential |

| Large EPZ | US, EU (Export) | AGOA trade benefits, low labor cost, tax holidays. | Trade agreement renewal risk, reliance on foreign buyers. | High (5-7 years typical payback period for large CAPEX). |

| Mid-Scale Local | Kenya, East Africa | Government/institutional contracts, Buy Kenya initiative. | High energy costs, competition from Asian imports. | Moderate to High (Crucial for vertical integration). |

| Micro/MSE | Local Tailoring/Retail | Low overhead, specialized services, high-margin bespoke work. | High revenue volatility, limited access to finance. | Quick turnover, high local returns on low investment. |

IV. Kenya’s Textile and Apparel Regulatory and Trade Framework

Below are the key regulatory and logistical frameworks that Kenya has established to attract T&A capital.

A. Strategic Policy Framework

The Fibre, Textile, and Apparel sector is a top priority under the Kenya Investment Authority (KenInvest) and the “Big Four Agenda.” The national goal is to increase exports to $2 billion USD annually and directly employ 2.1 million people within the next decade.

B. EPZ and SEZ Investment Incentives

Kenya’s Export Processing Zones Authority (EPZA) offers one of the most compelling incentive packages in Africa for export-focused manufacturers:

- Fiscal Benefits:

- 10-Year Corporate Tax Holiday: Complete exemption from Corporate Income Tax (CIT) for the first ten years, followed by a reduced rate of 25% for the subsequent ten years.

- 10-Year Withholding Tax Holiday: Exemption on dividends and remittances to non-residents.

- Perpetual Exemption from VAT and Customs Import Duty: Zero-rated status on all raw materials, machinery, equipment, building materials, and production inputs. This significantly lowers the initial CAPEX and recurring OPEX.

- 100% Investment Deduction: Full investment deduction on new investments in EPZ buildings and machinery.

- Procedural and Logistical Benefits:

- One-Stop-Shop Service: EPZA minimizes bureaucracy, offering a single license and streamlined administration for all necessary approvals.

- On-Site Customs: Resident Customs staff handle documentation and inspection on-site, ensuring rapid clearance and operational efficiency.

- Liberalized Finance: Unrestricted foreign exchange regime and easy repatriation of capital and profits.

C. Market Access and Regional Integration

Kenya’s geographical position and trade agreements offer unparalleled market reach:

| Trade Agreement | Target Market | Key Advantage for T&A |

| AGOA (African Growth and Opportunity Act) | United States | Duty-free access for nearly 6,400 products, including apparel (until 2025/2026). The primary driver for large-scale investment. |

| EAC & COMESA | East and Southern Africa | Duty-free market access to the East African Community and Common Market for Eastern and Southern Africa (400M+ consumers). |

| AfCFTA (African Continental Free Trade Area) | Pan-African | Provides simplified and harmonized market access across the entire continent, reducing barriers to intra-African trade and enabling the development of continental value chains. |

| EU/UK (Economic Partnership Agreements – EPAs) | Europe | Duty-free and quota-free access to the European Union and the United Kingdom, diversifying export risk away from sole reliance on the US market. |

D. Building the Backward Linkage

A critical opportunity for investors is the massive push for vertical integration. Currently, Kenyan garment EPZs must import most of their fabric. Government policy is strongly incentivizing investments in ginning, spinning, weaving, and dyeing mills to create a complete ‘farm-to-fashion’ value chain locally. Investing in these upstream activities provides guaranteed off-take from the highly profitable EPZ manufacturers and qualifies for the same, if not greater, investment incentives.

Conclusion: Seizing the African Textile Renaissance

The Kenyan Textile and Apparel sector is at an inflection point. It offers a clear path to profitability for large-scale investors through its strategic export platform, backed by strong fiscal incentives and competitive labor costs. For the entrepreneur targeting the local market, success lies in specialization, quality, and leveraging the burgeoning demand for proudly Kenyan-made products.

The data is clear: whether you are a global investor seeking a reliable green manufacturing base with duty-free access to Western markets or a regional entrepreneur aiming for a high-margin niche in institutional wear, Kenya provides the structured ecosystem, the supportive policy framework, and the geographical advantage to become a major success story in the African textile renaissance. The time to invest and weave your legacy in Kenya is now.

For those considering starting a smaller venture, like a tailoring business, this video offers localized insights into the practicalities and profit potential: How to start a tailoring business in Kenya.