In this blog post, we’ll discuss debt management in Kenya; importance of managing loans, how to assess your loans burden, and strategies for paying it off fast.

As you know, heavy debt can have a negative impact on your financial and health. High levels of debt can lead to stress, financial insecurity, and even impact your credit score. That’s why it’s so important to take control of your debt and develop a plan to pay it off commonly known as debt management. Whether you’re dealing with Tala loan, HELB loan, or a bank loan, it’s important to take control of your debt and develop a plan to pay it off.

How do you manage debt in 4 easy steps?

Managing debt is not an easy task, you can summarize it into 4 simple steps listed below; Remember in managing your debts and work towards a debt-free future, be patient, persistent and consistent in your efforts. Besides. don’t hesitate to consult or a financial advisor or debt manager for professional guidance.

How to assess your Loans & Debts

The first step in managing your debt is to assess your debts. This should include knowing the type of debt, the creditor, the interest rate, and the minimum monthly payment.

Assessing debt is not a one-time task, it’s important to review your loans periodically to ensure that you are making progress and adjust your strategy accordingly. Remember that the key to managing debt is to be consistent, persistent and remain patient.

How do you assess your debts? The process involves 3 steps;

- Listing all your debts.

- Evaluate each debt terms and conditions

- Calculate all your debt amount

These steps are further explained below

Developing your loans schedule

The first step in assessing your debt is to create a list of all your loans. This may include personal loans such credit card debt, student loans, online loans such as Tala loan, log book loans, and any other type you may have.

For each debt, make sure to note down the creditor, the interest rate, and the minimum monthly payment.

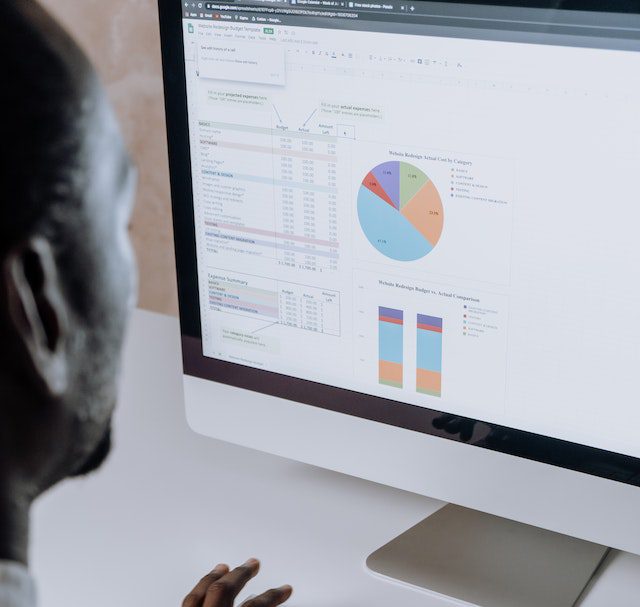

You can use a spreadsheet such as excel or a notebook to keep track of your debts, or you can also use a budgeting app to help you organize your information.

How do you evaluate debts?

Once you have a comprehensive list of your debts, it’s important to understand the terms and conditions of each one.

Make sure to read the fine print and understand the interest rate, any fees, and the repayment terms. It’s also important to know when the debt is due and when the interest rate will change.

This information will help you prioritize which debts to pay off first and develop a plan to pay off your debt.

Calculating the total amount of debt

With all your debts listed and the terms and conditions understood, the final step in debt assessment is to calculate the total amount of debt you owe. Add up the outstanding balance of all your debts to get your total debt. The number is important to have a clear understanding of the amount of debt you’re dealing with in order to create a plan to pay it off.

Once you have a complete list of your debts, you can begin to assess your financial situation and understand the terms and conditions of each debt.

Prioritizing which loans to pay first

Which is the best way to pay off multiple debts? More interestingly, which of your loans should be paid first and why? How do you Prioritize which debts to pay First ?

Once you have a clear picture of your debt, the next step is to prioritize which debts to pay off first. There are two popular methods for prioritizing debt, the “snowball” method and the “avalanche” method.

The Snowball method

The snowball method involves paying off the smallest debt first and make minimum payments on the larger debts. Once the smallest debt is paid off, the money that was used to make payments on that debt is then applied to the next smallest debt. This continues until all debts are paid off.

Benefits of snowball debt payment method

- It will give you sense of accomplishment and motivation as small debts are paid off quickly.

- You will stay motivated and on track with your debt repayment plans.

- It can help you to build momentum and reduce the overall amount of interest paid on the debts.

Challenges of the snowball loan repayment method.

- It may not be the most efficient if you have to delay paying some large debts with a high interest rate, it may be more beneficial to pay that off first, rather than the smaller debt with a lower interest rate.

- The method can be less effective for those with a significant amount of debt, as it may take a long time to pay off all the debts.

The Avalanche method

The avalanche debt payment method, on the other hand, involves paying off the debt with the highest interest rate first. You will then make minimum payments on the other debts. Once the debt with the highest interest rate is paid off, the money that was used to make payments on that debt is then applied to the next highest interest rate debt. This continues until all debts are paid off.

Benefits of the avalanche Debt repayment method

- It is more efficient than the snowball method. When you pay off the debt with most expensive or interest rate first, it can save a significant amount of money over time.

- It can also help to reduce the overall amount of time it takes to pay off all the debts.

Challenges to the avalanche loans repayment method

- It may not provide the same sense of accomplishment and motivation as the snowball method.

- It can be costly to pay off the highest interest rate debt first, as it might take a long time.

Whichever loans payment method you choose, the goal is to pay off your debts in a strategic and efficient way.

How can you repay your Loans fast?

How can you pay your loans faster? There are several strategies that you can use to pay off your debt faster. In this post, we’ll discuss 3 strategies for paying off debt fast, Loans consolidation, negotiating with creditors, and increasing your income.

- Loan Consolidation allows you to combine multiple debts into one loan with a lower interest rate. This can help you save money on interest payments and make it easier to keep track of your debt repayment plan.

- Negotiating with creditors involves working with you to review the loan terms and conditions. It can include ways to reduce your interest rates or create more favorable repayment plans such as extending loan period. This can help you save money on interest payments and make it easier to pay off your debt.

- Increase your income. This can include taking on a side hustle, asking for a raise, or finding ways to boost your earning potential. By increasing your income, you’ll have more money available to put towards paying off your debt.

How to stay free of debts in future

Staying out of debt is just as important as paying off debt. Once you’ve achieved a debt-free status, it’s crucial to maintain it and avoid falling into the same financial traps that led you to debt in the first place. In this blog post, we’ll give you 3 tips.

- How to create a budget and stick to it

- The importance of emergency savings.

- How to avoid common traps that lead to debt.

Remember that it’s important to have a clear understanding of your financial situation, consult a financial advisor for professional guidance and make adjustments as needed.

How to create a budget and stick to it

Creating a budget is one of the most effective ways to stay out of debt. It allows you to track your income and expenses, identify areas where you can cut back, and plan for future expenses.

To create a budget, start by listing your income and all your expenses, including fixed expenses such as rent, and variable expenses such as groceries. Next, subtract your expenses from your income to determine if you have a surplus or deficit.

If you have a deficit, you will need to make adjustments to your budget by cutting expenses or finding ways to increase your income.

Once you have a budget in place, it’s essential to stick to it. To do so, it’s helpful to track your spending and make adjustments as needed. Automating your budgeting process, setting reminders, and creating a visual representation of your budget can also help you to stay on track.

Why you need emergency savings

Another crucial aspect of staying out of debt is having an emergency fund. An emergency fund is a savings account set aside for unexpected expenses, such as a medical emergency, car repair, or job loss. Having an emergency fund can help prevent you from turning to credit cards or loans when unexpected expenses arise. It’s recommended to have at least 3-6 months of living expenses in an emergency fund.

How to avoid common traps that lead to debt

There are several common traps that can lead to debt, and it’s important to be aware of them in order to avoid falling into them.

One trap is lifestyle inflation, where people increase their spending as their income increases, which can lead to overspending and debt.

Another trap is overusing credit cards, which can lead to high-interest debt.

Additionally, not having an emergency fund or not having a clear understanding of your financial situation can also lead to debt.

To avoid these traps, it’s important to have a clear understanding of your financial situation, create a budget and stick to it, and have an emergency fund in place.

These 3 are the simple methods you can maintain your debt-free status and achieve financial stability.

Final words

Debt management is a crucial aspect of achieving financial stability and security. In this blog post, we’ve discussed the importance of managing debt, how to assess your debts, strategies for paying it off and how to avoid the trap again in future.

You don’t have to wait any longer, to be financially free and successful. The goal is to start managing your multiple debts today. Consult a financial advisor or a debt manager for professional guidance and make adjustments as needed. With the right plan in place, you can achieve your goals, reach financial stability and live a debt free live.