Are you struggling to take control of your debt and loans situation? Anyone can feel overwhelmed by the constant phone calls and Texts and Emails from creditors. It’s a common situation for millions of Kenyans who find themselves Trapped in Debt. That’s why you need a professional debt manager.

A debt manager is a finance consultant who specialize in helping individuals and families to take control of their debts and achieve financial stability. In this blog post, we’ll discuss the role of a debt manager and the benefits of working with one to stay out of debt and pay your debts faster.

Roles of A debt manager

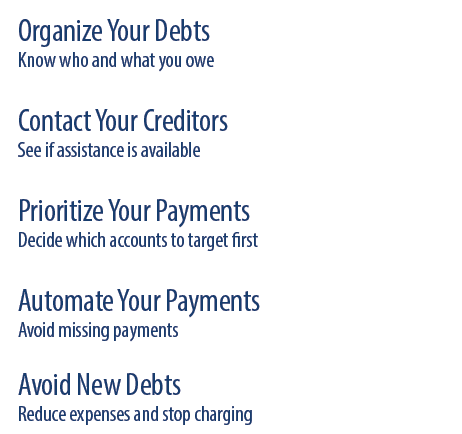

A debt manager can be an individual or a business. They have rich knowledge and expertise to help you understand your loans burden and paying it off without pressure. They can also help you negotiate with creditors, create a budget, and stay out of debt in future. In short they will help you to;

- Assess the individual’s or family’s debt situation

- Create a comprehensive list of loans, calculating the total amount of debts owed.

- Develop a customized plan for paying off the debt.

- Negotiate with your creditors to lower interest rates and create more favorable repayment plans.

Overall, a debt manager can provide guidance and support in developing a customized plan to pay off your loans. They can help you prioritize your debts, implement strategies such as consolidation loans and negotiation with creditors, and make smart, informed decisions about your money. With their expertise, you can take control of your debt and achieve financial stability.

How a debt manager helps you to repay debts faster

Why do you need to hire or consult a debt manger? They can help you pay your debts faster and keep you free of debts in future. We now focus on 3 ways that they can do this;

- understand your financial situation. Your debt manager will help you to create a finance plan that is tailored to your current and specific needs. Since they have more finance knowledge and expertise, they understand better the dynamics of cash management. You will get guidance to track your cash flows, create a budget and invest your excess money to create wealth.

- Negotiate with your creditors. Your lender is more than willing to reduce your interest rates and create a more favorable repayment plan for you. But, it is difficult to handle the technical negotiations on your own. A debt manager can handle the negotiations on your behalf. It can help you save money on interest payments and make it easier to pay off your debt.

- Create a budget and stick to it. Your finance consultant can help you to make a budget given your cash flows. Given your surpluses, you can establish an emergency fund for unseen expenses. She can also help you to avoid the common traps that lead to debt. Besides, he can help you to automate your payments, set reminders, and create a visual representation of your budget to make it easy for you to keep track of your spending.

How does a debt manager keep you free of debt

Paying off debt is just the first step towards achieving financial stability. Staying out of debt is just as important, and a debt manager can help you stay free of debt in 3 ways; providing guidance and support in creating a budget, sticking to it, establishing an emergency fund, and avoiding common traps that lead to debt.

A debt manager can help you to establish an emergency fund, which is a savings account set aside for unexpected expenses such as medical emergencies, car repairs, or job loss. Having an emergency fund can help prevent you from turning to credit cards or loans when unexpected expenses arise.

To create a budget, your debt manager will help list all your income and expenses and determine your financial stability. Expenses include both fixed expenses such as rent, and variable expenses such as groceries. Next, subtract total expenses from your income to determine if you have a surplus or deficit. If you have a deficit, you will need to make adjustments to your budget by cutting expenses or finding ways to increase your income. Once you have a budget in place, it’s essential to stick to it. To do so, it’s helpful to track your spending and make adjustments as needed. Automating your budgeting process, setting reminders, and creating a visual representation of your budget can also help you to stay on track.

Additionally, a debt manager can help you avoid common traps that lead to debt, such as lifestyle inflation, overusing credit cards, not having an emergency fund, or not having a clear understanding of your financial situation.

A debt manager can be a valuable asset in your journey to financial stability. They have the knowledge and expertise to help you understand your financial situation, create a plan to pay off your debt, negotiate with creditors, create a budget, and stay out of debt.

Why you need a debt manager today !

Working with a debt manager can provide you with the guidance and support you need to take control of your debt and achieve your financial goals. They can help you understand your financial situation, create a comprehensive list of your debts, calculate the total amount of debt you owe, develop a customized plan for paying off your debt, establish an emergency fund, and avoid common traps that lead to debt.

In summary, managing debt is crucial for financial stability, and a debt manager can provide professional guidance and support throughout the process. Don’t wait any longer, take the first step towards financial success and contact us to start managing your debt today.