Are you interested in starting a consulting business in Kenya? For decades, the discourse on economic growth in Kenya and across Africa has centered on manufacturing, agriculture, and infrastructure—the tangible foundations of a growing economy. However, a quiet, high-margin revolution has been underway: the ascent of the Services and Consultancy sector. This industry, powered by intellectual capital rather than heavy machinery, is fast becoming the new engine of economic prosperity, offering unprecedented opportunities for high-net-worth entrepreneurs and strategic investors.

This in-depth guide is designed to be the definitive go-to source for individuals looking to understand, enter, or invest in Africa’s burgeoning knowledge economy. We will dissect the business models, reveal the financial blueprints (including a mock cost account for a Kenyan firm), and analyze the profitability metrics that define success in this lucrative sector.

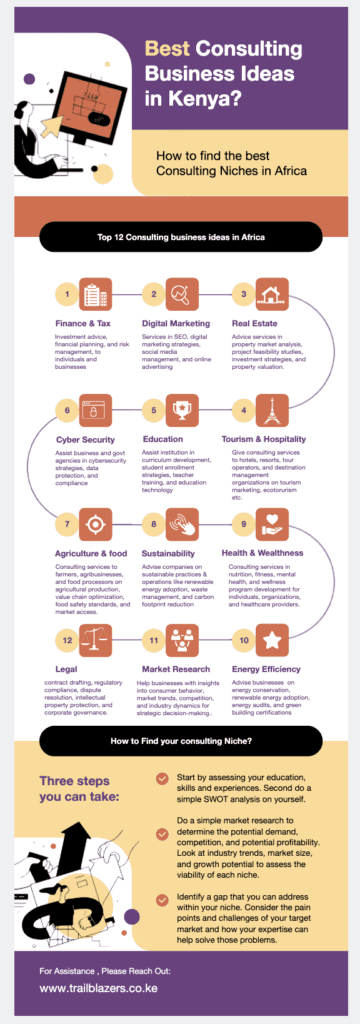

Best Service and Consultancy Business Models for the African Market

Services and consultancy firms are fundamentally businesses that sell expertise, time, and specialized knowledge to solve specific organizational or market problems for clients. Unlike product-based companies, their primary assets are human capital and proprietary methodologies. The services sector is not monolithic; it encompasses a diverse range of specialisms and business structures.

The Core Types of Consulting Ideas in Africa

The African market, driven by rapid urbanization, technological leapfrooging, and a complex interplay of local and international investment, demands specialized expertise:

- Strategy Consulting: Operating at the highest level, these firms focus on corporate, organizational, and economic policy strategies, often advising C-suite executives on market entry, mergers & acquisitions, and long-term positioning.

- Management Consulting: The largest segment, covering organizational concerns from efficiency to process re-engineering. In Africa, this often involves Supply Chain optimization, digital transformation, and capacity building.

- Financial Advisory Consulting: Critical in markets with complex tax and regulatory environments. Services range from M&A and corporate finance to risk management, tax restructuring, and forensic accounting.

- Human Resources (HR) Consulting: Addressing human capital challenges, including talent management, change management, organizational design, and transforming business culture.

- Niche & Technology Consulting: This rapidly growing segment includes highly specialized areas like AI/Machine Learning Consulting and Fintech Advisory, catering to Africa’s vibrant tech ecosystem.

The Best Business Models in Consulting and Service Industry

An entrepreneur’s choice of model directly dictates the initial cost, the necessary team structure, and, crucially, the potential for profitability and scale.

- The Solo/Independent Model:

- Description: The consultant is the entire business—delivering services, managing clients, and making all decisions.

- Cost Profile: Minimal initial cost, primarily for a laptop, software licenses, and basic business registration.

- Profitability: Highest profit margins, often reaching 70% to 85%, as there is virtually no staff overhead. Revenue is directly tied to the individual’s time and expertise.

- The Firm Model (The Partnership/Limited Company):

- Description: A scaled structure involving multiple employees, partners, and systems. This model allows for taking on larger, more complex engagements.

- Cost Profile: High initial investment in office space, technology, employee salaries, and professional services.

- Profitability: Revenue is generated through margin—the difference between what the client pays and what the firm pays its team. Healthy gross margins are typically targeted between 40% and 60%. This is the scalable, investor-attractive model.

- The Productized Model:

- Description: Expertise is transformed into repeatable, systematic, standardized solutions, such as a template for a market entry strategy or a specific software implementation process. Only about 20% of the solution is customized.

- Cost Profile: Requires significant upfront investment in developing the standardized solution (software, training materials, documentation).

- Profitability: Offers the highest scalability potential and margin stability, as revenue is decoupled from billable time, moving closer to a software-as-a-service (SaaS) model.

- The Hybrid Model:

- Description: The most common evolutionary path, where a firm offers high-touch custom consulting (The Firm Model) alongside scalable, standardized packages (The Productized Model) to stabilize cash flow and maximize leverage.

How Profitable is Consulting Business in Kenya?

Is a services and consultancy business profitable? Unequivocally, yes. When structured and managed correctly, professional services firms offer some of the highest margins and greatest returns on human capital in the economy. Success is measured not by inventory turnover, but by efficiency metrics centered on human time.

Global and Industry Profitability Benchmarks

For entrepreneurs and investors, understanding the financial health of a professional services firm requires moving beyond simple revenue figures and focusing on specialized metrics:

| Metric | Definition | Benchmark for Professional Services | Implications for African Firms |

| Gross Profit Margin | (Revenue – Direct Costs) / Revenue. Direct costs are employee salaries and project-specific expenses. | 30% – 60% (Varies significantly by service complexity) | High specialization (‘rocket science’ like AI consulting) commands the higher end (>50%). Commodity services (routine tasks) have lower margins. |

| Net Profit Margin | (Net Profit / Revenue). Takes into account all expenses (salaries, rent, taxes, operations). | 15% – 30% is considered healthy. | Reflects operational efficiency. Leveraging remote work and technology can significantly push this margin upwards by reducing overhead. |

| Billable Utilization Rate | (Billable Hours / Total Available Hours) × 100. | 75% – 85% is ideal for staff. | The utilization rate is the lifeblood of the business. A consultant working 40 hours per week with 30 billable hours has a 75% utilization rate. Keeping non-billable hours to a minimum is essential for boosting profit. |

| Revenue Per Employee (RPE) | Total Revenue / Number of Employees. | Highly variable, but used to measure workforce efficiency. | A key metric for growth potential. A firm generating KSh 200 million with 10 employees has an RPE of KSh 20 million. Investors look for consistent RPE growth. |

How to boost your Consulting business Profits in the African Context?

African consulting firms have unique opportunities to optimize their margins:

- Value-Based Pricing: Moving away from limiting hourly rates to flat fees or value-based pricing ensures the firm captures the value of the outcome delivered, not just the time spent. For a firm that helps a client double their revenue, the price should reflect that massive value, not just the 100 hours of work it took.

- Technology and Automation: Investing in project management software, time-tracking tools, and AI-driven internal automation significantly reduces operational costs and streamlines workflows, allowing employees to spend more time on billable work and less on admin.

- Strategic Resource Management: Efficiently matching the right consultant to the right project is crucial. Lack of real-time visibility into how resource plans affect project profitability is a major challenge, and firms that embed strategic resource management into financial planning will gain a competitive edge.

The Cost of Starting a Consulting Business in Kenya

The cost to start a consultancy firm varies dramatically based on the chosen business model (Solo vs. Firm) and specialization (General Management vs. Niche Engineering). We focus here on a Small-to-Medium (SME) Consulting Firm (Pvt. Ltd. Company) specializing in general management and technology advisory, based in Nairobi, Kenya.

The initial investment for a limited liability consultancy firm can be categorized into four phases: Regulatory & Legal, Capital Expenditure (CapEx), Initial Operating Expenses (OpEx), and Working Capital.

Estimated Cost Account (In Kenyan Shillings – KSh)

| Category | Item Description | Estimated Cost (KSh) | Notes & Statutory Basis |

| I. Regulatory & Legal Startup Costs | |||

| 1. Name Reservation & Approval | Business Registration Service (BRS) | 950 | Merged process with registration. |

| 2. Private Limited Company Registration | BRS Fee & Stamp Duty | 10,650 | Certificate of Incorporation issued within 3-5 days. |

| 3. Legal/Consultant Fee | Professional fee for registration process (Lawyer/Consultant) | 25,000 – 50,000 | Varies by firm; essential for accuracy. |

| 4. Professional Body Licensing (Example: Engineering Firm) | Processing (KSh 2,000) + Registration (KSh 30,000) + Annual License (KSh 30,000) | 62,000 | Highly variable. Only applicable to regulated fields (e.g., Engineering Board of Kenya, Architectural, etc.). |

| 5. Trade/Business Permit (County Level) | Nairobi County Permit (Varies by size, employees) | 15,000 – 50,000 | Annual fee required for physical operations. |

| Sub-Total (Regulatory & Legal) | KSh 113,600 (Using high-end estimates including professional licensing) | ||

| II. Capital Expenditure (CapEx) | |||

| 6. Technology & Equipment | 3 High-spec laptops, printer, secure router | 300,000 – 500,000 | Investment in reliable, high-speed technology is non-negotiable for service delivery. |

| 7. Office Setup (Minimalist) | Desk, chairs, small meeting area (if not remote) | 100,000 – 200,000 | Can be eliminated by opting for a fully virtual office or co-working space subscription. |

| Sub-Total (CapEx) | KSh 400,000 – KSh 700,000 | ||

| III. Initial Operating Expenses (OpEx) – 3 Months | |||

| 8. Office Rent/Co-working Space | 3 months rent/subscription (e.g., KSh 30k/month) | 90,000 – 180,000 | Critical decision for reducing overhead. |

| 9. Utility/Internet/Communication | 3 months (KSh 10k/month) | 30,000 | High-speed internet is an essential resource. |

| 10. Software Subscriptions | Project management, accounting, CRM, Cloud storage (3 months) | 45,000 | E.g., QuickBooks, Asana, Microsoft 365. |

| 11. Marketing & Branding | Website design, initial branding assets, business cards | 75,000 – 150,000 | Necessary for establishing market credibility. |

| 12. Professional Indemnity/Liability Insurance | Annual Premium (paid upfront or quarterly) | 50,000 – 100,000 | Essential risk mitigation for professional advice. |

| Sub-Total (OpEx) | KSh 290,000 – KSh 505,000 | ||

| IV. Working Capital & Salaries | |||

| 13. Team Salaries (1 Lead Consultant + 1 Junior Analyst – 3 Months) | Buffer for initial non-billable period | 600,000 – 900,000 | The largest initial expense; required to cover the period before significant project revenue starts flowing. |

| Sub-Total (Working Capital) | KSh 600,000 – KSh 900,000 | ||

| TOTAL MINIMUM STARTUP INVESTMENT (Excluding VAT Buffer) | KSh 1,403,600 – KSh 2,218,600 (Approx. US $10,000 – $16,000) |

Note: This mock account does not include a VAT buffer (Value-Added Tax). Firms with annual turnover exceeding KSh 5 million must register for VAT and manage these liabilities.

How to Navigate the Regulatory Currents in Kenya and Africa

Below are the key regulatory bodies and compliance checkpoints for starting and running a consulting business in Kenya

- Business Registration Service (BRS): This is the mandatory first step, determining the legal entity (Sole Proprietorship, Partnership, or Limited Company). A Limited Company, despite higher initial fees (KSh 10,650), is generally recommended for its limited liability protection and credibility with corporate clients.

- Kenya Revenue Authority (KRA): Tax compliance is a major operational commitment. Consultants and freelancers are subject to individual income tax on a progressive scale.

- Income Tax: Rates are progressive, starting at 10% and rising to 35% for higher earners.

- VAT: Mandatory registration for firms with an annual turnover exceeding KSh 5 million.

- eTIMS Compliance: All expenses claimed as deductions must be supported by eTIMS-compliant invoices, making digital record-keeping mandatory.

- Professional Regulatory Boards: Specialized consultancy requires accreditation. For instance, engineering firms must register with the Engineers Board of Kenya (EBK) and pay substantial annual licensing fees (KSh 30,000 for locals), ensuring the quality and safety of professional services. Financial, legal, and architectural consultants are subject to their own respective stringent bodies.

The Regulatory Challenge as a Competitive Advantage

For many SMEs in Africa, the regulatory burden acts as a barrier to entry. This is where strategic investors and professional firms find their advantage. A firm that prioritizes full compliance, utilizes professional legal/accounting counsel, and maintains transparent, digitized records is perceived as low-risk and credible—a critical factor when bidding for contracts with multinational corporations or government entities. Regulatory compliance shifts from an operational cost to a premium brand attribute.

Why you need to invest in Africa’s Knowledge Economy

The Services and Consultancy sector in Africa is on an irreversible upward trajectory, driven by macroeconomic and demographic forces that make it highly attractive to investors.

1. Demographic Dividend and Talent Pool

Africa possesses the world’s youngest and fastest-growing population. This demographic dividend is translating into a rapidly expanding pool of highly educated, tech-savvy professionals. Consulting firms that invest in developing this local talent and providing world-class training will secure a competitive edge and reduce reliance on expensive expatriate consultants. The rise of independent “solo consultants” in Nairobi and Lagos, leveraging this high-skill, low-overhead model, is a powerful indicator of market maturity.

2. Digital Transformation and Sectoral Specialization

The greatest demand for consulting services today is not in traditional management, but in enabling digital transformation. Expertise in data analytics, cloud infrastructure, cybersecurity, and regulatory technology (RegTech) is now highly valued. Firms specializing in these high-margin, ‘rocket science’ areas will naturally achieve and surpass the 50% gross profit margin benchmark.

3. Regional Expansion and Scaling

For investors, the opportunity lies in firms with a clear pan-African expansion strategy. Once regulatory and operational systems are proven in a market like Kenya—an East African hub with a strong regulatory framework and high connectivity—scaling across the East African Community (EAC) or into markets like Nigeria, Ghana, or South Africa becomes a matter of template replication. This scaling ability justifies the significant valuations investors seek.

Conclusion

The Services and Consultancy sector in Kenya and across Africa represents the future of value creation—a transition from a resource-based economy to a knowledge-based economy.

For the entrepreneur, this is a clear call to action: specialize ruthlessly, prioritize a high billable utilization rate, adopt value-based pricing, and view regulatory compliance not as a tax, but as a critical investment in your firm’s brand equity.

For the investor, the metrics are compelling: target firms with high net profit margins (15%-30%+) and demonstrated ability to scale Revenue Per Employee. Invest in the solo or hybrid models that show the potential to productize their services for maximum leverage and minimal operational drag.

By leveraging local expertise, embracing digital technologies, and mastering the cost structure outlined in this analysis, Africa’s knowledge entrepreneurs are poised to build the next generation of global professional services powerhouses. The gold rush isn’t in the ground; it’s in the collective intelligence of the continent.