This post will give you the best tips to avoid the common mistakes that African entrepreneurs make.

Are you an entrepreneur looking for the best business tips to grow your new business start-up?

The average start-up failure rate in Africa is around 54% as of 2020. There are many causes of business failure among African entrepreneurs. The challenges are even worse among women and young Africans. They include external challenges like expensive credit or individual mistakes poor entrepreneurial skills.

What are the key causes of start-up failure in Africa?

Are you wondering why over half of all businesses started in Africa fail? This table below gives you a summary overview of various challenges faced by entrepreneurs, the contributing factors, and the potential mistakes on their businesses survival and growth.

| Challenge | Contributing Factors | Impact |

| Lack of basic business skills and management experience | Insufficient knowledge in financial management, marketing, operations, etc. | Poor decision-making, ineffective business operations |

| Inadequate market research and understanding | Failure to research market, understand customer needs, assess business viability | Misalignment with market demands, low customer satisfaction |

| Inadequate Financial Preparation and Resources | Underestimating capital needs, lack of detailed financial projections | Financial instability, difficulty in securing funding |

| Poor business planning and lack of coherent model | Skipping business plan development, unclear business model | Difficulty executing strategy, inability to adapt to market changes |

| Undercapitalization and poor financial management | Insufficient capital, lack of financial skills | Cash flow problems, limited growth opportunities |

| Poor leadership, management, and delegation skills | Ineffective leadership, delegation, and overall management | Employee disengagement, operational inefficiencies |

| Starting a business for the wrong reasons | Lack of genuine passion or purpose for solving customer problems | Lack of motivation, higher likelihood of business failure |

| Failing to Monitor Progress and Adjust | Neglecting regular progress monitoring and plan updates, leading to missed opportunities | Missed growth opportunities, inability to address challenges |

| Ineffective Marketing Strategies | Using generic marketing approaches, ignoring local preferences and cultural nuances | Low brand awareness, poor customer engagement |

| Rushing Expansion | Expanding too quickly without a solid foundation, straining resources and inviting chaos | Operational inefficiencies, increased financial risks |

| Neglecting to Make a Business Plan | Starting without a structured plan, leading to directionless efforts and increased risk of failure | Inability to set clear goals, higher chance of failure |

| Ignoring Cultural Differences | Disregarding cultural sensitivities, leading to misunderstandings and eroded trust | Damaged reputation, loss of potential business opportunities |

| Overlooking Local Partnerships | Neglecting relationships with local partners, suppliers, distributors, hindering market understanding | Limited market reach, missed collaboration opportunities |

| Failing to Learn from Mistakes | Not embracing failures as learning experiences, hindering growth and resilience | Repeated errors, stagnation of business growth |

| Lack of focus | Serving too many market segments, offering too many products/services | Loss of competitive advantage, diluted brand identity |

How to Avoid common Mistakes that Entrepreneurs in Africa Make

As an entrepreneur, below are the 8 best business tips to consider in mitigating common mistakes and increase the likelihood of your business growth and success.

- Acquire necessary business skills and management experience through education and mentorship.

- Conduct thorough market research to understand target audience and competitive landscape.

- Develop a comprehensive business plan with clear goals and financial projections.

- Assess capital needs realistically and establish robust financial management practices.

- Cultivate strong leadership and management skills to adapt to market changes effectively.

- Embrace failures as learning experiences and use them to refine strategies.

- Build meaningful relationships with local partners, suppliers, and customers.

- Avoid expanding too quickly or diversifying excessively; maintain strategic focus.

The following tips are expounded further giving you more practical examples.

Seek advisors & mentors

An interesting fact is that you are not the first person walk the entrepreneurship journey. Relying on sound advice and guidance can help you sail the turbulent sea of competition and volatility.

Having a pool of knowledgeable mentors and friends for guidance and moral support can make your journey less treacherous. You can join a business network or reach out to good advisors personally. your mentor or advisor should be someone with adequate knowledge skills and experiences in establishing a successful business.

Finally, have several advisors with varied knowledge across a range of areas in your advisory board. The five top advisors or mentors to consider include

- Accountant/Financial Advisoe

- Legal Advisor

- Industry expert

- Successful Entreprenuer

- Networking Guru

- Digital Marketer

But remember you only rely on those people for expert advice. You are the final decision maker and Implementer of those decisions.

Register Your Business

The importance of business registration is achieving formalisation or institutionalization.

Majority of micro, small and medium enterprises in Africa are unregistered. It means they have no certificates or licences with local authorities or national registrar of businesses.

There are many advantages of registering your business. They include Having access to professional management team that owners may be lacking. Having strong control measures of the business operations such as statutory requirements and external reporting.

The above benefits among others are good for business survival and continuity. It encourages growth from a simple business entity into a complex business enterprise over time.

Record Keeping

The devil is in the details it has been said. A successful business is the one records its history and documents all its plans.

Comprehensive record keeping is not just about financial accounting. It involves maintaining good records such as business policies and procedures, business plans, marketing strategy and M&E progress reports. The idea is to have a robust record of all that happens in the organisation.

With good records, you will future reference of the good practises to adopt and a record of what does not work.

Appropriate accounting

The major goals of starting a business are to earn a profit, remain liquid and build wealth for the owners.

Accounting is the art of measuring and communicating your business economic goals. The financial performance information is summarised through the four primary financial statements.

- Statement of financial position (Balance sheet).

- Income statement (Profit and Loss account)

- Statement of changes in equity

- Statement of cash flows.

Additional information is provided in financial disclosures, notes and budgets, tax accounts provided alongside the above statements. The accounting practise is complex and carried out by qualified professionals. If you are not a qualified or a certified accountant its highly recommended to hire or outsource an accounting professional.

Business planning and planning cycles

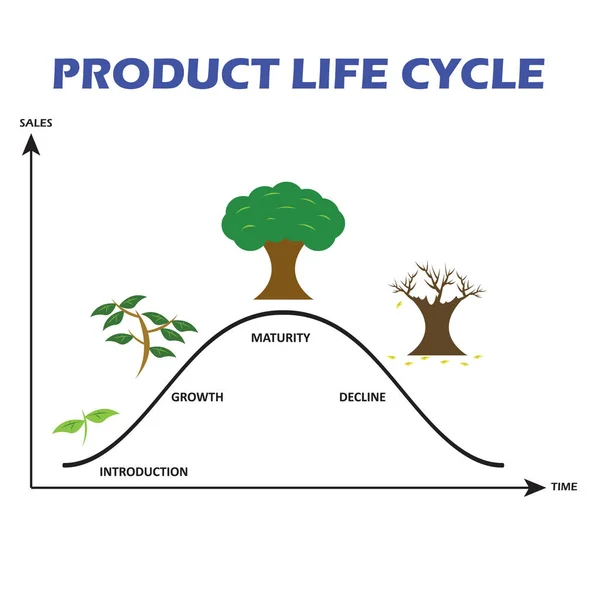

Do you know that organisations have their own business life cycle from a start-up to exit.

According to this concept organisations are born, go through a rapid growth, reach maturity, and finally die.

The performance and tactics for survival at each stage is different and requires detailed planning and a pre-determined steps to take at each stage. These are usually pre-determined in advance and documented in two important documents the business plan and the strategic plan. The first defines the revenue generation practise that will be adopted while the second is concerned with the long-term vision determination of where the organisation wants to be. Importantly is the road map and the direction to beat competition.

A business plan and a strategic plan do not guarantee success in themselves. Its rather a practise of determining where one wants to go and definition of steps to undertake to reach there. It’s an appreciation of risk component in business practise and suggestions of ways to eliminate or cushion oneself against business shocks.

Investment appraisals (Budgeting)

Can your business be comfortably funded by your savings or its profits only?

Some cheap sources of business capital in Kenya are donations, grants, and debts among others. Each source has its own pros and cons. A debt or loan can easily crump your financial performance over time.

To avoid this business risk, you will need to appraise all the available business capital source. Rank them from the best to the worst source. With a ranking of all investment sources, it will inform your decision on cheapest type and source of capital.

Discipline

If you cannot be disciplined it’s not very advisable to start a business, for sure it will fail.

Running a business needs a lot of commitment and dedication. It is also limiting, and you will never be doing what you need. Forget about becoming your own boss. The business is the new boss, and she is a bossy boss. The areas that you need a lot of discipline especially when the business is young include.

- Expenditure ensure you do not “eat” or spend all profits. Ensure you pay yourself a monthly salary. Save profits for business growth and operations.

- Time management. Your stakeholders need some kind of predictability, and it also cultivates reliability.

- Fulfil all your promises to clients, suppliers, and other stakeholders such as creditors. Rich relationships and partnerships are the rich ground which all success in life sprouts from.

Risk mitigation

The only thing that is certain about the future is uncertainty. When risks occur, they are capable of derailing or collapsing your business.

As a businessperson, you have to take risks in order to earn profits and remain sustainable. To survive business risks an organisation must have a risk mitigation strategy to either eliminate all, or most or some of risks.

Some strategies to manage risks in your business

- Fire Safety: Have fire extinguishers, smoke detectors, and emergency exits in place and regularly check and maintain them.

- Security Measures: Install CCTV cameras and access control systems for premises security.

- Cybersecurity: Use firewalls, antivirus software, and conduct regular data backups to protect against cyber threats.

- Insurance Coverage: Get appropriate insurance policies like liability, property, and business interruption insurance.

- Contingency Planning: Develop plans for supply chain issues, equipment failures, or natural disasters.

- Diversification: Offer various products/services and target different customer segments to reduce risk.

- Employee Training: Train employees on safety protocols and emergency response procedures.

- Regular Risk Assessments: Conduct regular assessments to identify and address new risks proactively.

By following these steps, startups can better protect themselves and increase their chances of success.