In this article, we give you the best tips on how to spend money wisely for happiness. You can benefit from avoiding excessive borrowing and reckless spending. Careful following them can help you to live abundantly as you get out of debt and completely stay out of it.

Jane Doe receives a net salary of KES 120,000. In the first five days after her payday, she lives like a princess; she takes a taxi to her workplace, dines and wines at five-star hotels, and is all over e-commerce sites shopping for stuff she does not need. By the tenth day, she is already broke and asking for advance payments from her bank and mobile payment platforms.

If you can relate to the story above, You are likely in a vicious circle of reckless spending, excessive borrowing and always running out of cash before the next payday. I can guess you do not contribute enough funds towards an emergency fund for a rainy day. A slight delay in your salary can seriously cripple your financial well-being and peace of mind. But is it supposed to be so?

The following five tips can help you to spend your money wisely, set aside money for savings, and avoid debts.

- Affordable budgeting

- Track all your expenditure

- Prioritize your expenses

- Adjust your Budgets

- Treat yourself

Affordable budgeting

The first step of restricting your running away spending and free of debt or borrowing, is sticking to an affordable budget. It will help you live within your means if you stick to it religiously. An effective budget has the following three steps:

Related: Do You Want Financial Freedom? Hire a Debt Manager

Determine your cash receipts

List down all the cash you will be receiving in a given time like a month.

Expected cash flows = (salaries, wages & tips) + (Reimbursements) + (Loans) + (Dividends) + (Interests) + (other income)

The common sources of income for individuals are wages and salaries, allowances like transport and internet, gifts, bonuses, or loan repayments from friends. Other cash receipts you may receive are incomes from your investments like house rent, dividends from your stock, and interest from treasury bills.

Determine your expected expenses

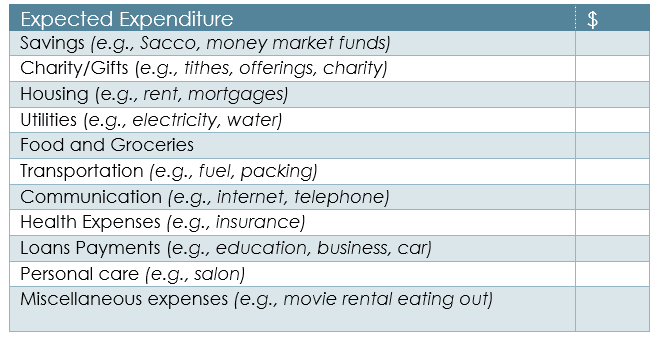

The second step is to list the items and services you will be paying in a for the coming month. Make it like a normal “shopping list”. you will specify the items and amounts for various items and calculate the total cash outflow you expect to be paying for them. Some of common expenses for individuals and families are shown in the diagram below;

As shown, you need to budget some amount to go towards savings as a priority. Other expenses include housing, food and groceries, communication, and loan payments.

Analyze your budget

The final step is to analyze or compare your estimated cash expenses against expected cash receipts. To do this you will subtract the total expenses from your total expected income.

Total expected cash– (Less) Total estimated expenses = Balance (-/+)

Where your income can cover your expenses (+ balance), your budget plan is affordable and you are doing well financially. The best way to spend any balance is to save or invest it in an income-generating asset like a savings account. Where your expenses exceed your income, you have a deficit budget. You cannot afford it without seeking additional income from others. To solve this problem, prioritize some of your expenses or adjust your budget as further explained in steps 4 and 5.

Track your expenditure

Tracking how you spend each coin is the most important step to spending your money wisely. You will track and record your actual spending. You can record the transactions each day, week, month or whichever period works best for you. Instead of recording them on paper, notebook or diary, you can download electronic tools like a spreadsheet (excel) template or personal finance management apps

To make sure you are not missing any transaction, maintain all your receipts, m-banking notification text messages, transaction confirmation messages, and a copy of your bank account statements from your bank or financial service provider.

Benefits of expense tracking

Tracking expenditure has two benefits in your journey towards wise spending and saving.

Determine any cashflow variances

You will do a simple analysis of what went well. If you end up spending more than what you had budgeted for, revise your next budget upwards to cover all your basic needs, wants, and any incidentals. If you end up underspending, save these extra amounts in an emergency fund or invest in an income-generating account. If you end up falling short of liquidity or cash availability, it is time to diversify your income to reduce the uncertainties of cash flow and achieve full financial freedom.

Identify the biggest Expenses

Which items in your budget are draining your pockets? If you have not been tracking your receipts, it might surprise you how the snowball effect of seemingly negligible expenditure. Your small purchases on snacks, coffee, and night-out dinners can have a huge portion of your total budget. It does not mean you stop enjoying life’s pleasantries and luxuries. Just add an extra line to your monthly or weekly allowance. It will also help you set a spending ceiling to avoid overstretching your budget

Prioritize expenses

The next step after tracking your budget, its time to improve your expenditure by prioritizing expenses. You can track expenses for at least 3 months to have sound averages for decision making. To prioritize expenses, use the data from various expenses you have gathered in the previous step 3. Classify them into the following categories

- Basic needs: these are necessities for survival that you must pay for first. They include food, shelter, clothing, and health expenses.

- Luxurious Wants: These are important expenses but not very critical. They include expenditure on eating out, taxi fare, magazine and gym subscriptions.

- Miscellaneous expenses: These include all other expenses that do not fall into category one or two above. You can ignore these without having any adverse effect on the quality of your life. These include road trips, cable Tv, safari and entertainment.

Make budgetary adjustments

The goal of these steps is to use the budget and the record of your expenses to spend your money wisely, set aside money for savings and avoid debts. You will allocate enough cash for basic needs first and necessary luxuries. Most of your miscellaneous expenses like gym and Netflix subscriptions that you do not fully utilize should be cancelled. Then channel the money you save from unnecessary expenses to pay any outstanding debts faster.

Treat yourself

A yearly holiday is good for your physical and mental health. However, most people end up broke in January after overspending their cash savings during the December Christmas holidays. But the secret to treating yourself well and having an affordable holiday is budgeting for one in January. Contribute small amounts of money towards this goal each money.

For Instance, instead of drawing a holiday expense of $5,000 in one month, open up a holiday savings account. Contribute $ 400 per month for 12 months.